A World Without Money?

Posted by nate hagens on December 31, 2008 - 7:04pm in The Oil Drum: Campfire

Our Wed night/Saturday TOD:Campfire series continues. In addition to having 'practical' essays on topics our community has expertise in, the intent is also for these slots to be a home for unprovable, perhaps untestable ideas, from which (perhaps) testable and worthwhile ideas emerge. Since it is New Years Eve, meaning tomorrow marks a new mini-beginning, (and the fact that traffic will be low...;-), below the fold is a short thought experiment. Imagine what the world would look like if tomorrow morning we woke up, and all money in the world had disappeared.....

No money. Empty bank accounts. But everything else remains the same....

Let's take as given there will be general chaos for a period of time, pretty much everywhere. Just-in-time medical prescriptions would be disrupted, dog and cat food supply would stop, and all sorts of other unpleasant trajectories that would accelerate adverse feedbacks to the system. For the benefit of getting worthwhile discussion from this post however, let's avoid debating whether this temporary anarchy would be a 6 or a 9 on the 1-10 nastiness scale, and look beyond to the eventual order and type of structures that would emerge, be it in 3 days, 3 weeks, or somewhat longer.

With no money, in our pockets or in our banks, financial 'capital' would at least temporarily cease to exist. Though it exists now as an abstraction that facilitates commerce and trade, money is really only a marker representing the 4 real categories of capital: built capital (wind turbines, shovels, books, houses, lumber, tools, etc), natural capital (land, animals, trees, riparian zones, ecosystems, fresh air, sunlight, etc.), social capital (friends, trust, networks, communities, family, etc.), and human capital (knowledge, skills, social acumen, experience, etc.). The moment money disappeared, all these 'real' forms of capital would instantaneously increase in value, some more than others. The global GINI coefficient, (a measure of income/wealth disparity) would plummet (ones 'worth' would now be measured by these real assets as opposed to digits - there would be quite a shift in the Forbes 400). I suspect 'knowledge' and 'who one knows' would loom large as assets, as traditional paychecks, bribes, payments in a service based economy, etc. would no longer be denominated in paper currency or bank transfers.

The major difference between this thought experiment and the real world is the speed. With a slow decay of the financial system, the existing elected officials and businessmen will eventually construct some new Bretton Woods III. With money disappearing overnight, different organizational themes might emerge. Over time, as has always been the case, leaders would rise to the top, both locally, and regionally. A plausible scenario would be that some areas of the world would centralize around some powerful warlord (who might now be wearing a suit and tie): other areas would be communities led by committee of friends/peers - kind of a bimodal distribution somewhere between HBOs 'Deadwood' and Kunstlers "A World Made By Hand". In either environment, irrespective of whether the leaders were local or national, anarchist or top-down, basic goods would almost certainly be reasserted as top priority: food, fresh water, sanitation, heat and electricity, medicine, etc. To make things more convenient, a new 'currency' would eventually be issued. What would it be based on? Would prior claims be attempted to be 'matched' in the new currency? Would prior liabilities be 'forgiven'? Would people be happier (after the initial nastiness?)

While industrialized nations may not have directly undergone this experiment, some have come close - 2001 Argentina and 2008 Iceland come to mind. Money 'existed' but was only available to withdraw in small amounts. At the other end of the spectrum, modern day Zimbabwe has PLENTY of money - in fact, my brother enclosed a 10 billion Zimbabwean Dollar Note in my Christmas card.

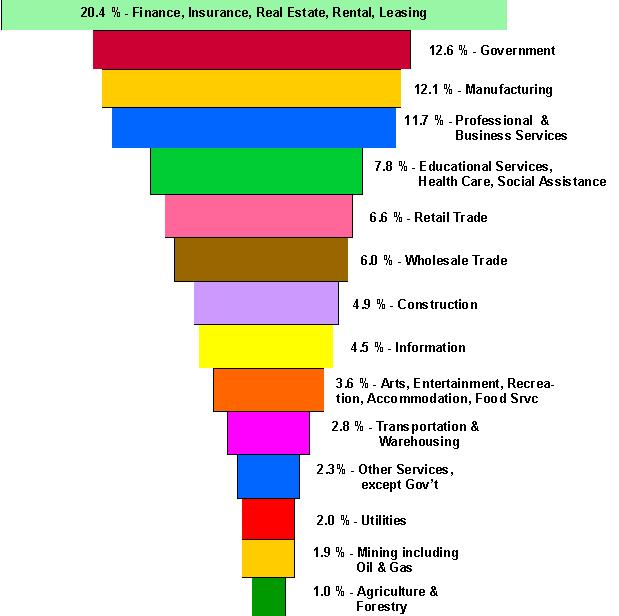

The production of goods is accomplished by human and natural capital. When denominated by money, here is how our economy 'stacks' up, by industry, as a % of GDP:

(from Upside Down Economics, by Kurt Cobb)

Without money, perhaps it would look something more like this?

Money has allowed us to increase efficiency, to reduce redundancy and increase aggregate 'profit'. Trade benefits from specialization have made nations 'monetarily' better off, though without money, most of these advantages not only disappear, but become liabilities. Import substitution policies that were suppressed by the Washington Consensus now look attractive. Regions where industry and production of basic goods occurs locally will have an advantage, almost irrespective of who is in charge. Undoubtedly money will emerge again, because trading a cow for 2 computers and some skis is awkward. But what will it be based on?

Money no longer exists, and has no meaning. You are in charge. How do you structure things?

This thought experiment is not TOO far removed from present day reality...Have at it - there are no 'right' answers, and Happy New Year...;-)

* A paper worth a read Natural Capital, Human Capital, and Sustainable Economic Growth

* The concept of the 4 capitals is outlined in Chapter 5, "A Four-Capital Model of Wealth Creation", in the book, Real Life Economics, by Paul Ekins

**Thanks to my massage therapist Kathy for helping me envision a world without money

I am afraid your thought experiment is not too far removed from reality--in fact it is a real issue, as we look at a world with far more debt and derivatives than real assets.

The questions I have are, "How much of current commerce would be able to continue? How does one operate an electric utility without money? Do you call (assuming telephones are available) Wyoming, and promise to send a trainload of Georgia wood back if Wyoming will send you coal for your power plant? (A hydro-electric power plant might do better, as long as long as a part isn't broken, the river isn't frozen over, and it still has enough oil for lubrication.) How could gas stations operate, if electricity for pumping fuel (in pipelines and at the gas station) is not available? Without oil and gas, and with very little electricity, how could a big business like a telephone company, or a refrigerator manufacturer, continue to operate?"

I am afraid we would have only the food that is locally in storage, or currently growing. Clothing would be just what is in our closets. Golden Retrievers would only be helpful, if they could find their own food, and provide some services in additional. Medicine would be whatever is in our medicine cabinet.

The new currency would most likely be local. It could be based on some quantity of food or labor. It probably wouldn't be tradable at any distance. We would go back to the days before oil and gas, and mostly to the days before electricity.

Well, thinking "new currency" seems to me to be thinking too much inside the box.

The best example is the fall of the Soviet Union. The monetary "system" (along with everything else) fell apart. What remained? Bartering.

And a new, rising system of "power". The warlords, or better "godfathers" surfaced. When "the Russian Mafia" was mentioned around the world, people got scared.

These were the people who got things done or hurt you 'cause you didn't do your part.

Money is the anonymizion of power. If the money system falls apart, then suddenly the system gets very personal.

Power personal. Mafia. Godfather. I'll take care of you here. But you have to support me with your life..

Feudalism is a complicated (advanced) form of the Mafia economy.

Cheers, Dom

Well, let's see....

Assuming no money, at least for some period of time, barter becomes the economic "coin" of the realm.

No money, most current jobs disappear. Most current jobs exist primarily so people can earn money to consume stuff. In a world without money most of the existing systems have come to a screeching halt. After the smoke clears, work will be centered on two things: growing/obtaining food and making things/providing services that can be bartered for food.

Anybody with land, climate, ability, etc. to grow food will probably be doing so, bartering any excess for additional labor, supplies, etc. Depending on location, people with hunting/gathering skills should be able to gather sufficient stocks to survive and barter.

The remaining folks will have to come up with skills that are useful in the new society. Primarily, these will be skills that provide goods and services used in the production and delivery of food, or that provide the other basic necessities of life. Depending on their specific skill sets some veterinarians, doctors, nurses, and teachers may be able to parlay those skills into food. Actually, I'm not sure about teachers. I suspect that all adults and most teenagers will need to be working at sustaining themselves and their families. Maybe grade school/high school teachers might be necessary, but I'm not entirely convinced, at least at first. People with woodworking or craft skills may be able to create enough business to survive. People who can repair things, carpenters, mechanics, plumbers, and other mechanical/creative types will probably have plenty of work as things break down and must be repaired (as they can no longer be easily replaced).

Eventually, some kind of local money will evolve, if only to grease the wheels of barter. Depending on the availability of transportation and communication, perhaps regional or national currencies will come back into existence. I would be shocked if any of these were not tied directly to some underlying asset. It could be gold, energy, food, livestock, timber, land or something completely different. I just don't see much likelihood of some kind of fiat fractional-reserve money system reappearing.

If money were to disappear, I think you end up with a very different society. Different professions. Different relationships. Different social, political, and security structures. I think almost everything ends up focused on the exchange of physical goods or services directly or indirectly tied to the core task of obtaining the basic necessities of life (food, water, shelter, basic medical care, etc.). People with skills or resources that support that task will be in a good position, relatively speaking. Those that cannot will need to learn quickly or get used to some probably unpleasant alternatives.

Brian

Brian:

Some very interesting comments. However, one thing for the group to think about (and I will apologize in advance if this has already been brought up but I missed it because I have not read all the comments) is the issue of population and die-off. My very superficial appreciation of the population I come into contact with on a daily basis is that there are many many many individuals who have none of the right skills and would be hard pressed to come up with any other abilities to survive than those of functioning as a parasite. My fear,should money ever 'disappear' is that the parasites of society, i.e. drug dealers, criminals of every other ilk, etc. would find themselves in a tight spot, having no abilities other than the inclination to suck off of the rest of society. I fear there would be a period of absolute chaos with much loss of life and suffering. aBarter would be one way to survive, but what if you hve nothing to barter?

rdorrett - Those who know how to use a gun will have power of death. Those who know how to grow food will have power of life. The former need the latter, whereas the latter don't need the former. There will be many unskilled etc who are totally knocked out by the shock and/or go beserk. But for the most part, those demonstrating vital skills such as farming and mending will be respected rather than persecuted. About time too!

Clearly in a situation like this precious metals would become the only way to transact large international deals. Gold and silver would once again take their rightful place as the only real form of money.

If you look at how gold is on the climb again right now, you'll see that this is happening as we speak.

Gold Rises, Caps Eighth Straight Annual Gain, on Haven Demand

You say "clearly", but it's far from clear.

Historically people have used all sorts of things as currency. They've used,

- cocoa

- cowrie shells

- wooden sticks with marks on them

- gold

- silver

- iron

- cigarettes

- salt

- clay tablets representing a declining amount of grain

- electronic impulses

and zillions of other things.

What I found interesting was that during the Soviet colapse people traded things on their value compared to a snickers bar and shops paid out change in chewing gum. One man who was there said he went to one particular shop most often because they always paid change in the flavour of chewing gum he liked best.

I remember clearly a story from that time about a Soviet Union factory that paid its workers in sanitary napkins.

I can just see people doing huge international transactions in cowrie shells or salt. Pah-lease. And as for "electronic impulses", they are what are causing the problem right now — fiat rubbish — so it's hardly the best option for the future.

I also don't imagine huge international transactions in gold or silver. We only have about 160,000 tonnes of gold in the world, total - 0.024kg or less than one ounce of gold for each of the 6.7 billion people on Earth. Or if we consider silver, about 43 billion ounces have been produced ever, about 6 ounces each. The medieval silver penny had a bit over a gram of silver, so that 6 ounces would allow some 170 pennies.

Would this really be enough currency for all the transactions people want to make?

My point was not that any particular way of having currency was the best, but that there were very many different ways of doing things throughout history - not just silver and gold.

Yes! Let's say 1 dollar = 1 yoctogram. Plenty for everyone.

In absence of money there won't be any international anything anyway.

Beyond their industrial demand, precious metals are fiat currencies just like anything else.

Who does not understand this, has not read his history of money. Gold bugs can argue what they want, their arguments are not based on history or reality.

As such, if the thought game calls for a breakdown of not just the first line of money (national fiat paper currencies), but all forms of money, then it's back to barter we go. You have fish, I have grains. Let's barter.

However, before we would get there even in an imaginary scenario like that, I do believe we'd go through some other form of currency first. Maybe precious metals, maybe something else.

But let's not make the mistake of saying that any 'money' has inherent value, when it's all based on a social 'fiat' contract.

But barter with this many people would HAVE to have a new currency. Otherwise it would be too cumbersome -so the question is - how would society be organized and what would the rules be for the new currency? An energy backed one like Hubbert and the Technocrats suggested? Or a basket of basic commodities? I agree however, that gold will not play a long term role. Yes it represents embodied materials, but so does a car, or a barbecue grill. I think future currency backing (on a full planet) will have stronger links to real resources (energy, food, water, etc.)

How it will be done - that I don't know. But I figure starting from scratch we could at least tease out what principles would be involved...

Some of the community-based and/or intentional community barter systems use a time system. You work or trade an hour for a set amount of value. A key point is that all work has equal value. An hour of lawyering is equal to an hour of babysitting. (This has implications for education, of course, but again, if all education is given equal value and/or is merit-based - say, highest achievers getting their choice of major - then it might not matter.)

The starting value would be arbitrarily set, I imagine, but from that point on, there wouldn't be much need to adjust it up or down. If some resource isn't available, then that resource is doled out at a fraction of the set value. Anything that there's plenty of, well, there's just plenty of it.

Just thinking by the seat of my pants again, so blast away, folks.

Cheers

Nate-

But I HAVE to have a Mercedes convertible by next week, so the money WILL be coming from your account, etc...

In the real (hypothetical!) world, barter with this many people will fail to have a new currency for some time (due to lack of confidence even after one is organised). And consequently people will be forced to try to cope with a hopelessly cumbersome barter system.

ccpo-

More like a year of lawyering is already becoming equal to jack shat. Ask the 40 lawyers already disposed of by the top firm in this city.

Whereas I think you'll regret those words a lot.

With a failure of money there would be such a breakdown of the life-support system that a great dependence on local personal relations would take over. It would be much more to do with work exchange than things exchange.

I think the cumbersomeness of barter gets overstated a lot. That's not to say that money wouldn't re-emerge, if only because we live in a society heavily adapted and accustomed to fiat currency, but I do think it is important to recognize that barter systems can be very complex and sophisticated, and that monetary exchanges don't always *replace* - that is, barter offers refinements over and above monetary systems in tight-knit communities, among people where money is short (ie, the poor who never have a lot of access to currency), and it operates, when frequently used, to enmesh people in relationships with one another - often permanent ties, since nothing ever comes out "even" in bartering.

We tend to view economic history as a one-way trip away from barter, and towards currency by preference, because currency is so preferrable to barter. And for some things it is - but for some things it isn't, and it might be more accurate to argue that part of the problem has been the prioritization of a way of life that made barter seem inferior, rather than the inherent limitations of barter.

Sharon

I don't think it's inherently an either/or. The sticking point seems to be in applying a value. It is interesting to note that in the 17 and 1800's inflation was incredibly slow and stable. I forget where I read it, but I'm sure it was from here at TOD, but there was something like an 80 year period in the 1800's or so with virtually no inflation...

So, if we can determine a value that has some inherent value and, by extension, generally perceived validity, AND set up the system so it simply can't be screwed with, then it doesn't matter if you use a note to represent the "real" good(s) or not.

Or, so it seems to this non-economist.

Cheers

I think talk of a barter system is idealistic nonsense. It sounds good but be careful of what you wish for.

Governments need fiat money and taxation to keep the peace, to enable elections, health services, education and public services like police, coast guard, border patrol and weather forecasting etc.

Maybe look to Somalia to gain an insight in a system without government.

When you come up with a fair barter system which can pay the sailors and airmen, police and teachers with bags of beans then you have success.

I don't discount that bartering could become a means of survival but if it becomes widespread, it will most probably mean we have anarchy, warlords and slavery and a whole damn lot more misery than necessary.

I agree with you that a barter system would work. Why couldn't someone trade a certain weight of gold for a certain amount of fish?

Money does have inherent value, otherwise its not money. Gold and silver have inherent value; just look at the tremendous amount of effort and risk that is undertaken to remove it from the earth. By the way, definition for fiat - An authoritative command or order to do something; an effectual decree. Surely you don't believe that gold and silver only have value because the government says so? Because if you think about it, they would much prefer that you think the opposite. Follow this logic, and Gold and Silver are really anti-fiat money.

This thought experiment is interesting to me, as a proponent of free-markets and limited government intervention.

What I'm about to propose might be a little out there. I think that we already live in a world without money. How could this be, you ask? Well, think about what we currently use as "money". We use paper notes issued by the government, which are nothing but a promise that this paper will have some purchasing power in the future. It is fiat money ("fiat" means by decree, so our money is only money because the government says so, and because people believe it). Here are a couple of attributes of money that would probably arise in a free-market for money.

1. Store of value - In a free market people would look for money that would be the best store of value. As noted by Kiashu, that could constituent any good that has utility or is deemed valuable by people for any reason at all. Since 1913 the US money supply has been inflated by 1300%. That inflation means devaluing currency, hardly a solid store of value. Meanwhile, gold purchases roughly the same amount of goods in 1913 that it does today, it has not devalued at all. See gold/oil ratios over the past century and although there has been a range, its roughly unchanged.

2. Inherent value - Does our current money have utility? What can you use paper or 0's on a computer for? There is no inherent value for the latter and very little for the former (toilet paper?) Given that in the US, the dollar has lost 95% of its value (1300% inflation) since 1913 and the creation of the Federal Reserve, in a free market would you hold US dollars for any reason at all? Maybe some would, but I doubt many would consider promises from politicians to be more valuable than tangibles such as gold,silver,oil,land etc.

Another interesting thing to note is that in that inverted pyramid, finance and its derivatives rests at the top. A system based on real money would probably see Finance closer to the bottom or near the middle. Here's a great example, the FDIC insures all bank accounts up to $100,000. Consider gold as money; there would be no need for this entire organization if we had gold as money, because your money would be sitting in a bank vault, and would not be lent out to either people 10x over (fractional reserve banking). This is just one example, another big one would be that there would never have been a market for credit default swaps, a type of derivative that acts as insurance when a company goes bankrupt. These types of financial instruments, which total over 1000 trillion worth, are only possible under a system of endless monetary expansion. Another example, the ponzi schemes of social security and Medicare would not be possible with real money.

So instead of desiring a world without money, we should be asking for a world WITH money. Real money, not the counterfeit paper that is pushed out by the quasi-government-criminal Federal Reserve and all Central banks the world over (every country has one). In the US, our lack of real money keeps us forever in servitude to the owners of the Fed, with us wondering how in this age of prosperity we only seem to ever increase our debt. I think if people realised that they pay interest on debt which they themselves issued (Fed receives Treasury bonds in return for working a printing press), which brings in $100's of billions to the owners each year, they would be all for real money. The constitution of the US only allows the Federal government to issue money in the form of gold and silver. Maybe the Founding Fathers were on to something.

I would love some constructive criticism on this; I'm writing my undergraduate thesis on the destructive nature of central banking and the case for free-market money, and any comments would be much appreciated.

Oh, but the USDollar and most modern money is backed. It's issued by the government and will be paid out with next year's (or in 30 years') taxes. It's backed by the power of taxation. They'll take your gold away, if it is deemed to be the most effective tax.

Now, it would only be a shame if next year's taxes are less than this year's..

"I would love some constructive criticism on this; I'm writing my undergraduate thesis on the destruction nature of central banking and the case for free-market money, and any comments would be much appreciated."

Don't waste your time. Free markets only work in a utopia where everyone would follow the rules and not act “human” [irrational]. The Federal Reserve is a result of “free markets”. Individuals or groups will always gain more capital [power] over others and they will form cartels. There exists a drive within humans to have power over others and those with power will conspire together for more power. You can put in all the “checks and balances” in whatever form of government you can dream up but it will be as corrupt as the humans the designed it.

Seriously you might as well write your undergraduate thesis on the destructive nature of humans, then you might be getting closer to the answers you seek. Good luck, but seriously, free markets are dreaming with your eyes open…

==AC

"Physiologists should think before putting down the instinct of self-preservation as the cardinal instinct of an organic being. A living thing seeks above all to discharge its strength — life itself is will to power; self-preservation is only one of the indirect and most frequent results"

"My idea is that every specific body strives to become master over all space and to extend its force (its will to power) and to thrust back all that resists its extension. But it continually encounters similar efforts on the part of other bodies and ends by coming to an arrangement ("union") with those of them that are sufficiently related to it: thus they then conspire together for power. And the process goes on."

~Friedrich Nietzsche

Although you might believe that free-markets are dream, or utopia, my point is only to show that we would be better off. I'm not concerned with how improbable this is, just what would result in a return to sound money. My whole point is that sound money limits the power of those in control to devalue your savings endlessly and use your money for evil means.

If people desired to be free, and understood the game, we could end this control tomorrow. It would only take individuals to bypass central banking currency altogether. There is no law against what can be used as a medium of exchange. For example, we could use gold and silver coins to exchange goods between each other, and not use paper currency at all in the process. If these coins were once issued by the government, they would be legal tender, and taxes would only be paid on the face value. The effect would be a completely legal way to pay less tax, and usurp the power of the political majority. Another benefit to this is that it would strengthen local economies, as people would have more purchasing power, as the Fed would not be able to use the invisible inflation tax.

I never said it would be easy to create a system free from control of the elite, but the first, and most important step is to take away their credit card. Quickly, the American empire disintegrates; without the common citizen to pay the bills war and destruction would be limited. No longer would poor people have to go kill other poor people for the sake of the ruling elites. It would take a revolution, but with the only other option being endless slavery for our masters, is it not worth trying?

"I'm not concerned with how improbable this is."

If you are not concerned with the probability of it happening why waste your time?

"No longer would poor people have to go kill other poor people for the sake of the ruling elites."

At what period in human history did this not exist in some form post hunter-gather? As soon as there is any sort of agricultural surplus it will create economic inequality and class war will form.

"It would take a revolution, but with the only other option being endless slavery for our masters, is it not worth trying?"

One you slaughtered the top a new top would form and the cycle would begin again. There is no way out you are trapped if you want to lay down your life for some ideological cause, be my guest. May you find some sort of meaning or comfort in your existence because of it. The only advice I could really offer you was this little tidbit a read today:

"Stop trying to make a difference.

in trying to make a difference,

we grow attached to our efforts, and

the ideology that drives these efforts.

And attachment is at the root of suffering.

Thus, to let go of our attachments to

'make a difference' is to let go of suffering."

Good luck in your quest...

==AC

I would rather live one day as a free man, than a whole life as a slave.

Thanks for your support.

Fallacy of the excluded middle.

Specific to what?

Specific to the one thing you said. What else?

Between the absurd and rarely seen extremes of a single day as a perfectly free man and a lifetime as a slave there is a middle ground of a life where some rights are compromised for the sake of other rights or other people, and where you live not a single day nor a hundred years, but another 30 years or so.

So of all the things I wrote, thats where you choose to find the fallacy. missing the point no?

The quicker you realize you have been and always will be a slave the fuller your life will become. The freedom you seek can only be found in the graveyard, where all are truly "equal" and "free". Maybe like Kazanzakis you can have the epitaph "I want nothing, I fear nothing, I am free." chiseled into your grave stone. I am merely pointing out the contradictions in your romanticized notions of freedom and the myths you are perusing. Below is a link to a short piece that gives a brief summary of some of the myths you are holding as the highest good:

http://tinyurl.com/6wbket

==AC

“Each person “has” an idea of the absolutely real, the highest good, the greatest power: he may not have this idea consciously, in fact he rarely does. The idea grows out of the automatic conditioning of his early learning; he “lives” his version of the real without knowing it, by giving his whole uncritical allegiance to some kind of model of power. So long as he does this he is truly a slave; not only is he unconsciously living a slavish life but he is deluding himself too: he thinks he is living on a model of the true absolute, the really real, when actually he is living a second-rate real, a fetish of truth, an idol of power.”

~Becker, “The Birth and Death of Meaning”

Hi Chenri,

With all due respect, as a proponent of free markets and limited government intervention how do you explain the ongoing economic debacle? Is it not the product of free markets, and the deliberate reduction of government intervention?

The uncontrolled and 'out-of-regulatory-sight' creation of elaborate financial instruments is what just wrecked the global economy. Trillions of dollars of debt-based pseudo money was thereby created by a market that was 'free' of government intervention. No Fed or central bank was necessary.

The Federal Reserve is, as you stipulate, quasi-governmental. In other words, less subject to government intervention than if it were an actual component of the government. Indeed, the Fed is just a private board of directors representing the interests of private banks, but with the special privilege of creating money out of thin air. Are you proposing that it be relieved of that special privilege, and that the creation and control of currency be put back under the exclusive control of the government?

If so, then would not the regulation of money supply fall entirely upon the Treasury Department, thus increasing (not decreasing) the government intervention in business matters that you find objectionable?

Looks to me like the can of worms you propose opening might overfloweth.

Hi D. Benton Smith,

Thanks for responding. I will try and answer the case for the free market as best I can. This is a very broad topic, so forgive me if my response is a little narrow.

Most economists would agree that the current economic debacle was triggered by the increasing defaults on Sub-prime mortgages, which is both a result and cause of the real estate market bubble popping. Most economists would also state that this collapse is due to deregulation that saw the financial institutions recklessly lending, seemingly without any regard for the future. Oh my, how the free market has failed, they cry. We need more government regulation and nationalization to ensure that this does not occur again, to make sure that the nasty free market doesn't cause so much damage.

This issue can be understood in the same way as the question of what our world without money would be like. I argue we don't have money. I argue that we don't have anything that resembles a free market either.

In order to understand subprime mortgages, one must understand that there exists two Government-sponsored entities called Fannie Mae and Freddie Mac. These two quasi-government entities subsidized mortgages for people who, under more-prudent rules of borrowing, would never have qualified for a loan from a conservative banking institution. In fact, Fannie and Freddie Mac hold half of all mortgage debt in the US. Without Fannie and Freddie buying up this mortgage debt, there would have been no market for debt that could never be serviced. Without the governments intervention, the free-market would have ensured that these loans would not have been made, and the result would be that we would not have a major collapse in real estate prices, nor would we have had a major run up in property prices.

Here's a quote from Congressman Barney Frank in 2003 , "I want to roll the dice a little bit more in this situation toward subsidized housing." Of course, when the luck eventually runs out, and the massive fraud is exposed, its quite convenient to blame the free-market and advocate even more government to solve the problem which they themselves created. Kind of like the fox eating some of the chickens, and than believing that only the fox should look after the chickens.

With regards to your question about the money supply being given back to control of the government. Here are two articles from the constitution;

Article I, Section 8, Clause 5: The Congress shall have Power…To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures.

Article I, Section 10, Clause 1: No State shall…coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debt.

The founding fathers understood how the Republic could be undermined through paper currency. If Congress took over control of the money supply and followed the constitution, they would mint gold and silver. Congress (and government) would also be handcuffed; they would not be able to spend at will, for there power would be limited due to their inability to "print" more money. Mining gold and silver is a very difficult task, and the supply of both metals only increases by about 3% per year. So you see, even if congress wanted to expand the money supply, they would be prevented from doing so. Not only that but instead of selling debt to private banksters, in which every citizen has to pay interest on, Congress would receive the interest payments from the people, which could be used to cover costs of the government, rather than increasing the power of the Fed owners.

I understand that there might be objections to this, which is why I also wouldn't find it a problem to allow competition in currency. Let the free-market decide what should be money, just as letting the free-market decide who should receive mortgages would have largely prevented the current economic debacle.

Reasonable?

Oops.

I read your two articles of the constitution as saying something completely different than that fed. has to be gold/silver backed. If you remain with "The Congress will have power" and "No state shall", then you don't need to read the rest.

Federal govnt can make "money" out of anything they damn well please. It's call the division of power - we can, you can't. Again, it goes back to power. Power, power, power. States, on the other hand can not make money. They can only circulate gold and silver. The fed. can also take away ANY of the proposed currency solutions that are discussed here. And if they want to, they sure won't play around (see the ban on private ownership of gold in 1932 (?)).

And that's why they call it a dollar "bill". It's a bill of debt, a bill of obligation...

"Legally, they are liabilities of the Federal Reserve Banks and obligations of the United States government." (wiki)

For all those others claiming the oposite, it's NOT a store of value... (except in a time of deflation, but that's not intended..)

Which is probably your point anyway.

It is a promise of the powers that be to honor it's own debt. Just think if we were all allowed to do that!

But no. This power is held ALONE by the federal govnt. States can issue gold and silver coins - if they think they're so rich!!

Greetings from Munich,

Dom

SamuM wrote a post earlier that tidily sums up what many who agree in spirit with gold-buggers but disagree in practice think.

-

"Beyond their industrial demand, precious metals are fiat currencies just like anything else.

Who does not understand this, has not read his history of money. Gold bugs can argue what they want, their arguments are not based on history or reality.

As such, if the thought game calls for a breakdown of not just the first line of money (national fiat paper currencies), but all forms of money, then it's back to barter we go. You have fish, I have grains. Let's barter.

However, before we would get there even in an imaginary scenario like that, I do believe we'd go through some other form of currency first. Maybe precious metals, maybe something else.

But let's not make the mistake of saying that any 'money' has inherent value, when it's all based on a social 'fiat' contract."

-

i think gold is a cooler currency because its so shiny, but other than that, i have got to agree.

Chenri, AC, Kiashu.

I get a strange feeling you are all absolutely correct, simple looking from different frames of reference and what you words have evoked in me is:

Perhaps we need to change there core of what we are as a species, mayhap a phrase like "Conscious Spiritual Evolution" is what You have inspired.

I'm working on it but with little progress so far. Technically it is possible for US to evolve out of "automatic control of our nature by the given wiring of our primitive brain structure"

If we can develop an education system that bypasses what is now a completely inadequate brain structure, we may be able to eliminate animalistic urges such as greed and the desire for power over others.

Get rid of a few "cardinal sins" and the problem of currency holding a steady value dissapears.

I know it is difficult to see through my fog, I'll go find my flashlight.

You may find it dazzles a bit at first. I am dedicating my year 2009 to elucidating this theme of "Conscious Spiritual Evolution"

(Chenri, you asked for input, sorry it's not immediately helpfull)

In a world suddenly bereft of financial capital, there would be some very interesting re-orderings taking place within your four other categories of capital. The world already knows or suspects the kinds of re-orderings that could take place in such a world. For example, nurses and high-school teachers likely experience elevation, in such a world, in the human capital category. In the built-capital category, books and tools are elevated whereas toys and other discretionary items are demoted.

Restoration is a strong pattern in any disruptive event, however, so there would be those who would get very busy trying to do just that by attempting to restore money sytems. War analogies or wartime examples are relevant here. Money substitutes emerge. Liquor, for example.

I think ultimately what would be most revealing would be how quickly credit relationships get re-established. In fact, I think credit relationships would be rebuilt even faster than any re-establishment of money. Credit is nothing more than a means to shift tasks across time, into times of one's choosing. It's the foundation of modernity (imo) and efficiency. (I should acknowlege that money is also a form of credit). For example, I'd be delighted to start guitar lessons now, in Winter, for my neighbor's 10 year old son, in return for a share of their corn, tomatoes, and basil this coming Summer. That's both a barter and a credit deal.

Anecdote: my wife is both a psychotherapist and a nurse. She grew up and got all her nurses training in New Zealand. The history of nursing in NZ is intense, because, as a frontier society for many years nurses were the doctors for most communities. So, to this day, a nurse's education in NZ is grueling and very medical. Seeing how things played out in countries like colonial NZ and also Aus. give good clues as to how things would get shuffled now.

Here in Western Massachusetts we have a ton of niche/small scale farmers that produce all manner of stuff through the four seasons. When I drive by their farms, or see them at the Saturday open market, I think "these people are the future millionaires."

G

Credit (long enough for time-shifting) only works in a growing economy. I am sure there are a lot of folks who will try it again, and get burned again. It may be the foundation of modernity and efficiency, but it is going to be a whole lot more limited in the future. You may be willing to give guitar lessons in return for a share of their corn, tomatoes, and basil this coming summer, but I would be willing to bet you wouldn't give guitar lessons in return for a share of their corn, tomatoes, and basil five years from now. There are just too many contingencies that could arise, especially if one is doing without a lot of modern conveniences.

I would be willing to bet the small scale farmers use diesel to transport their produce to market, and tractors in the cultivation of their crops. Even organic farmers seem to use special organic "sprays" for their fruit crops. Seeds are generally hybrid seed that require considerable fossil fuel inputs. These farmers may be the future millionaires, but they have some big hurdles to jump to get to that point.

Yes and no. It's more true to say that credit encourages growth.

If money is only created when debt is created (as with US Treasury Bonds or bank-issued money as loans), then debt always exceeds the money supply. So people desperately try to produce more goods and services to grab the insufficient supply of money to pay back their debts.

Imagine that you start a business, say a bakery. At some point its profits allow you and your family to live comfortably. You will often decide to stop the business' growth there - you have all you need or want. But if you have a debt which is growing, then you'll try to have your profits grow faster than the debt grows, in the hopes of paying off the debt.

In this way, the debt always exceeding the money supply encourages economic growth.

It also encourages environmental destruction, abuse of human rights and so on. If you as a baker employ a worker and have decent profits, you will be happy to pay and treat them well. If you have enormous debts, you'll seek to both increase revenue and decrease costs, and part of the cost decrease will be to do things like make the worker do unpaid overtime. Likewise the woodcutter supplying your bakery with wood for the ovens, as you try to increase revenue by producing more bread, you also need more wood for the ovens. So while the woodcutter may know that he can only take one cord of wood per acre per year if he wants to keep the forest in good condition, that extra money you the baker offer him to cut an extra cord or two starts to look very tempting - especially if he also has some debts.

Kiashu is wrong here to say Gail was wrong. The point is that without expectation of growth no-one wants to provide the credit that depends on that growth for repayment (plus interest). That the (now nonexistent) credit would have stimulated growth is besides the point.

Why gold or silver? Any commodity can be currency? Gem stones? Titianium? Bronze?

In anything more than the most basic subsistence type of social order / economy some sort of currency will be required to pay for goods and services. Even barter currency would arise and have some sort of value.

This non currency is not going to happen on the scale of the human population organized in any way close to how it is.

If we assume that we still have working computers and telecommunications, then money need not be something that has traditionally been used for money. It need not be something 'valuable' like gold, silver, or gems. It could be something of relatively low value, like bricks, or charcoal brickettes. The reason that money in the past has been some like gems is that the expense of carting things like bricks around to pay for other stuff was too great and inconvenient. But, with telecommunications, and computers we can have computer records of how many brickettes each of us owns and where they are stored. The whole financial structure would very quickly come to look very much like what we have today - or more properly what we thought we had before the recent financial meltdown. Then, no one really held any significant cash. Most money was just a number in the computer memory slot called 'balance' in our computer bank account. With charcoal brickettes replacing dollars, the 'balance' would be a number of brickettes rather than a number of dollars. Not, to my mind, a big change.

I think it is impossible to make all money disappear, either over night, or over a millennium. Money is an idea. It is an invention. Once we know about it, we cannot 'uninvent' it.

I read recently a news report about prisoners in California state prisons using tins of sardines as money. They cannot have real money in prison. All their earnings from prison work are held in accounts at the prison commissary, and can only be spent of items purchased at the commissary. The commissary stocks tinned sardines. Viola, money! And a

regulated currency exchange!

If money suddenly disappeared, telecommunications would cease and few people would have working computers. My computer would work until my equipment sustains a major malfunction because my entire system is only indirectly reliant on the system. I have tools, parts and knowledge to repair my off-grid photovoltaic system and computers. When they fail, I probably would not have anything that I would trade to replace them. Food would be more precious. Computers would be sacrificed. Since people could not pay for electricity computers would become a thing of the past along with electronic currency.

Telecommunications would cease in less than a month. I pay for my Internet access via satellite system with debit card auto payment which would create debt as my account would have no balance. Since I could not pay the bill, I would immediately terminate my service. Nearly all of their customers would do the same simultaneously overloading their customer service department making communication with them difficult. Their customer service personnel would probably walk off the job immediately because the company would have nothing for their paychecks. I would have to go to the bank (assuming it is open and not burned to the ground) to cancel my debit card wasting the precious gasoline in my fuel tank. Without money I could not buy any gasoline. Would I trade a can of peaches for a gallon of gasoline? No, it would have to be more like one 29 ounce can of peaches for 10 gallons of gasoline. That is, assuming I could even survive the trip to town as people would kill me for my can of peaches.

The reality of erasing money overnight would be looting, burning, murdering and chaos just like in Argentina when they changed the currency stealing half of people's savings. People would essentially barter and steal for basic survival. Bullets would likely be valuable for barter.

I have been hesitant to jump in here because the concept is so mind boggling. "Paradigm Shift" doesn't even come close to describing it.

True, but in this new world, people will be looking to trade anything of value in order to survive. Electrical generation has value so even if payment is haphazard and marginal, it does provide income. The alternative is resources going idle in a period of upheaval. It may not be the suits, it may be the guys in coveralls that get the income, because they have the knowledge. Wise locals will back them up. The supply chain will respond similarly, with a difficult delay.

IMO, most people don't really know how to do anything useful, in a survival sense. In a world of no money, telemarketers are SOL. Altogether now "Awwwww".

I see a very ugly period where people are killed for peaches, but after the melee, the concept of value will go through some fast and drastic changes.

I can fix damn near anything (really) but if I can't strike a deal before I starve then I lose.

If I fix something and don't get paid (food) I starve, and lose.

If my skills are recognized, and I don't get shot for my sack of rice, I will prosper and will likely sire many children.

PC? Perhaps not, but resources, or the appearances of same have always been a deciding factor in survival. We are wired that way. Google "Bower Birds" if you don't believe me.

"What have you done for me lately?" becomes "What can you do for me right now?"

I can't see that scenario (yet) but as an exercise it exposes some ugly truths.

Lastly, this imaginary scenario is highly location dependent. The themes (and fears) expressed on this site are largely Americentric or from the "developed" world. Many areas throughout the world will adapt to a no money world easily or not require any adaptation at all.

Many (most?) in this world "get it" because they never lost it.

geek-

The idea that things cannot be uninvented is one of those myths that never die. In reality many things have been "uninvented", for just one instance in the 1950s it was well understood that it was lethally dangerous to attach a front mudguard stay near the axle on a bike. Then, progress took place with big self-service stores, at which the customer was (blissfully uninformed) King, and so customers insisted on buying the lethal designs because they "looked nicer". And now it seems that mudguards have been uninvented altogether (due to yet further McCustomerism).

In respect of trading relations, what is crucial is confidence in others. Once lost it can be very hard to re-establish. Those who have not judiciously prepared in advance are going to have a desperate time, regardless of how many guns they might masterfully control.

Yes, electricity does have value, but part of my point is that it is difficult to barter long distance or in large quantities. If the electrical power plant is 100 miles away or in another state, how do we get barter to them? After considerable time and expense, the meter reader could also be a bill collector driving around picking up items that could be given to their employees and parts suppliers. I suspect such a practice would increase energy consumption and be destined to fail due to the size, weight and number of items that must be transported. People would not have enough time to take barter to all of the service providers. Mailing packages would greatly increase cost and energy consumption eliminating many customers.

My Internet access via satellite provider provides Internet access to mostly rural customers in all of the lower 48 states. Collecting barter would be prohibitively expensive and impossible during inclement weather. This company would fail.

I can not envision a barter system working for 310 million Americans and much less for 6.5 billion people globally.

Elgin Groseclose on the history of money. 1934 ( pdf)

http://mises.org/books/money.pdf

Um... what did you trade?

;>

You don't have to imagine a World without Money, you only have to look at how the Swiss WIR business barter system has been operating for over 70 years.

Or any of the proprietary barter systems like Bartercard.

On the WIR system goods and services are exchanged not FOR Swiss Francs but BY REFERENCE TO Swiss Francs as a Value Unit.

That is to say, participants transact with each other by reference to the Swiss Franc and may extend interest-free credit (aka "time to pay") to each other. The buyer settles the credit in "money's worth" of goods and services etc rather than "fiat" Swiss Franc money, whether of the non interest-bearing paper object type, or the interest-bearing balance on a bank ledger type.

The discipline - which protects the WIR system against defaults on debit balances - is that participants have to put up their properties as security. ie the WIR is a "property-backed" monetary system. It turns over billions of Swiss Francs worth in value a year, and while it tends only to "tick over" when conventional finance is working, at times like this - when fiat money = credit is in short supply, the WIR comes into its own, which is why it came about in the first place....

The fact is that wherever a barter system incorporates credit the outcome is a monetary system requiring only a Value Unit as a reference, rather than as an exchangeable/acceptable object.

I believe that it is straightforwardly possible for such B2B barter to be not only introduced generally as a quasi-utility "Clearing Union", but also for it to be extended B2C to retail clients as well through the use of what I call a "Guarantee Society". This is simply a mutual guarantee agreement backed by all the users - sellers and buyers - who make provisions into a default fund for the use of the guarantee.

In this partnership-based "Peer to Peer" credit model banks do not operate as credit intermediaries putting their capital at risk by creating interest-bearing credit based upon it. Instead they act as pure service providers, managing risk, setting guarantee limits and dealing with defaults, all in return for a fee.

We would still need "money's worth" which most individuals and businesses find acceptable. That's where Peer to Peer investment through "unitisation" of property and energy comes in....

Unitisation: solving the Credit Crunch

Happy New Year!

I think what would work well at a local level would be a currency which,

- is a medium of exchange, not a store of value

- is backed by a basket of commodities which decline in value over time

- so that the currency itself declines in value over time

- and which cannot be lent at interest

I'll explain below.

Money today has two functions, as a medium of exchange and as a store of value.

A medium of exchange is plainly necessary, so that we don't have to note down which part of a living cow we'll give when we slaughter it in June for this hoe we get in January. I can give my mate Joe an IOU, "Jim owes Bob one-twentieth the cow Betsy". If I only accept IOU from Bob, it's just an IOU. If Bob can give the IOU to someone else in payment of his own debts and I'll give that one-twentieth of a cow to that person instead, that IOU has functioned as a medium of exchange. Money is simply an IOU anyone will accept.

Getting people to accept your money is the most difficult part, as creators of local currencies have found. This is why so many people instinctively look back at gold and silver with nostalgia, thinking that if the stuff has intrinsic value, people will accept it. Unfortunately gold and silver don't have intrinsic value, they're usually just pretty, and sometimes but not always useful.

It's not clear that a paper or electronic store of value is necessary, as opposed to just putting it in real goods, or getting share of a business, etc.

When money is a store of value, this encourages people to hoard it. This is especially true if they can lend it at interest; putting it in the bank is in effect lending it at interest to the bank, the bank then lends it at higher interest to credit card holders, mortgagers, etc. In this way wealth tends to concentrate into the hands of a few, and drain away from the many. Then when the wealthy few screw things up, it screws everyone up; whereas if wealth were more evenly distributed (not necessarily 1:1 for the top and bottom quartiles, but let's say 5:1 rather than 100:1), mistakes of the few would not ruin the many.

Having money as a store of value is thus inherently inflationary and creative of unemployment and poverty, since whether people hoard it at 0% interest, or lend it out at 5% interest, the total debt will always exceed the money supply. By definition, there's never enough money in the community to repay all its debts.

The solution then is to ensure that we have money which is a medium of exchange, but which is either not a store of value, or has a declining value over time.

The well-known examples of Worgl and the like show good evidence of this. Currency was issued, and had to be stamped each month to be valid currency, this stamp cost some fraction of the currency's value (one-tenth maybe, I forget how much). So your $100 paid you in January would be worth only $90 in February. This encouraged you to spend the lot today.

Further back in history, the Egyptians had large granaries which farmers were obliged to store their grain in. When you brought in (say) 100lbs of grain, they'd give you a receipt for it, a clay tablet with "100lbs, January" stamped on it. Anyone who brought that tablet back to the granary could get grain in exchange. But because rats and damp and so on ruined the grain over time, if you brought it back in February, you'd only get 90lbs of grain for it, in March only 80lbs, and so on. So the grain tablets functioned as a medium of exchange which was a declining store of value - and people spent them quick, giving life to the rest of the economy.

Obviously this would combine very badly with lending at interest. If you can lend $100 in January and have the right to demand that they give you $110 in February, then you make $20 profit, and again we have debt exceeding the money supply. So we'd have to ban lending at interest.

This seems impossible to us in our debt-laden economy. How would banks function, how would houses be built? Yet Islamic banks manage it, and Jews through history have had many successful businesses in this way. Rather than lending $100,000 at 5% to a restaurant owner so she can double the size of her restaurant, the bank simply becomes a 50% shareholder in the restaurant, and gets a 50% share of the profits... and a 50% share in the losses. This makes banks very cautious about who they invest with, makes them look seriously and in detail at them.

Would this be a bad thing, for banks to become more cautious in their investments? Nobody would get rich overnight, but while missing out on the booms we'd miss out on the busts.

Locally then what we could have is a warehouse which takes in grain, timber, cloth and the like, things for daily life. In exchange for these goods which perish they give currency which declines in value over time.

This could also be an indirect tax system. If the goods actually rot away at the rate of (say) 4% each month, then the warehouse owners (the state) could have the currency depreciate at (say) 6% each month. The 2% difference is currency they issue to pay people in state service, being police, building roads, manning libraries and so on.

The currency could not (by law) be lent at interest. That combined with its depreciation would mean nobody hoards it, so it gets spent and encourages production of other non-perishable things. Because it's a declining store of value people would seek to store value in other things, like improving the land they own.

I think this would work very well locally. As for currency at a state, federal or international level, I don't know what would work best. But since I believe that peak oil will mean a reduction in the range of our lives, perhaps preventing even city states from working well (at least as large as they are today), this doesn't concern me a lot. Money exists because people trade, not the other way around.

Money today is an Object. In fact Money is a relationship.

Credit - or time to pay - is implicit in a monetary transaction, but need not necessarily be "monetised". As I point out above, the WIR and other barter systems with in-built credit are proof of that.

We are accustomed to a system where we have actually monetised interest bearing IOU's created by credit intermediaries. Some - eg proponents of LETS - advocate monetising interest-free credit, which is fine where everyone trusts each other, but not where anyone games the system. LETS also do nothing for capital formation in terms of long term financing of productive assets.

I advocated in my recent annual lecture to FEASTA in Dublin the "unitisation" of land rental values - as follows:

Unitisation: a solution to the Credit Crash - Presentation

and

Unitisation: a solution to the Credit crash - Video

I believe that such unitisation not only solves the Credit Crash, but also creates what is an inherently local currency, since it is only redeemable for value against land rentals.

I also advocate the "unitisation" of energy, and believe that this creates the possibility of a new global reserve currency in the form of Units redeemable against a fixed amount of energy.

Financing Energy beyond Peak Credit

Combine an energy currency with a carbon levy, and it's game over.

The result is essentially to monetise the energy value of carbon, rather than to monetise - by political "fiat" - something inherently worthless, like CO2 or carbon credits.

As the guy said: "If you want to keep a donkey healthy, you don't regulate what comes out of it: you regulate what goes in."

It's no surprise to find that this whole useless Carbon industry is brought to use by the same people who monetised interest-bearing debt and thereby brought us the Credit Crunch.

An Inconvenient Truth, indeed.

NASA climatologist James Hansen has just published his letter to Obama. Some extracts:

http://www.columbia.edu/~jeh1/mailings/20081229_DearMichelleAndBarack.pdf

The full report is here:

http://www.columbia.edu/~jeh1/mailings/20081229_Obama_revised.pdf

" ...and the ability to explain the need for it to the public...."

That's the key phrase. Mr. O's ability to pull this off is going to be tested. But he just might succeed....

ChrisCook - inconvenient that that long thing about Obama jumped in straight after your intriguing post (not that that Obama thing was unworthy).

Anyway, that unitisation concept looks most interesting but that I didn't entirely grasp whether it is sound or not at first reading. Is it something you've invented? Has such a thing previously existed. Like the LLP system perhaps.

Hello Kiashu,

Well said, especially the paragraphs on Egyptian grain banking and the natural shrinkage from spoilage and rodents. This ancient system is the basis for my speculative 'Federal Reserve Banks of I-NPK' as the shrinkage level can be vastly reduced by controlling for Hygroscopicity [2-page PDF Warning]:

http://www.back-to-basics.net/agronomic/pdffiles/fertilizer_quality.pdf

------------------------

Physical and Quality Properties of Solid Fertilizers

------------------------

But the biggest advantage of using I-NPK over grain is 'human rats' are generally not going to steal this I-NPK, counterfeiting is impossible if purity sample testing is routinely applied, and the liquid jugs, bags, boxes, and/or pallets can be serialized as required.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Yes, but how do we handle the fact that human urine makes an extremely fine fertilizer, and can provide a private reserve of NPK - I for see difficulty reserving a pee-based currency, although it does provide novel opportunities for wealth increase "keep drinking, honey!" ;-).

Sharon

Yes, but how do we handle the fact that human urine makes an extremely fine fertilizer,

Other than the NaCl. It seems the way to bind the Na is via drying the urine, reacting it with sand and you get white P as a condensate.

Wrong on every count. Precious metals are rare in the crust, and difficult to extract (which is why they also embody the implicit value of their energy of extraction). They are also durable (you can find them unharmed after hundreds of years immersion in the sea, for instance). They are also useful. Silver for example has many uses other than the monetary one, and, as the most reflective metal, has a great future in the solar energy industry.

As I said, "sometimes but not always useful."

If the stuff is locked up in solar panels or computers or whatever, then it's not available for currency, is it? So we issue silver currency, then someone builds 1,000MW of solar panels, and we have a currency shortage, welcome to deflation. Hmmm.

The fact that gold is used in dental work or silver in microbicides, etc, does not detract from their value and rarity, and is not an argument to be used against their use as stores of value underpinning an electronic currency. I am also not averse to seeing other commodities used as underpinnings for electronic dollars, such as oil, copper, etc. It seems complex, but it's sensible and with computers, it can be done.

I'm sceptical of the notion of gold as priced by intrinsic value. That's because its price appears to be very subject to speculation, and its ownership very rarely related to its utility. Reminds me of why (inimitable) Stadivarius violins are much cheaper than (easily reproduced) Van Goghs -- because any billionaire can hang a painting on his wall but approximately none can play the Strad!

That's because the collapse of Bretton Woods relegated it to the status of a commodity. That can be reversed, simple.

Bretton Woods didn't simply collapse, it was kicked over :)

Not so simple to reverse, though. There'd be a LOT of debts we'd have to write off...

I don't understand why lending or interest imply that debts get ahead of the money supply.

Here's a scenario. Suppose banks do all the lending. I deposit an initial $100 into my bank account. At this starting point, outstanding money exceeds outstanding debt by $100.

The bank lends $90 to Fred. Now Fred has $90 in his bank account, I have $100, so the total money supply is $190. The total debt is $90. So the total money supply exceeds the total debt by $100.

Seems clear enough that money can move from one account to another and people can borrow money and repay debt in any arbitrary fashion, and the money supply will exceed the debt by the same $100.

How about interest? Suppose the bank pays 5% on deposits and charges 10% on loans. After a year, Fred's debt increases by $9, my bank balance goes up by $5, and the banker's bank balance goes up by $4. The total money supply went up by $9 but the total debt went up by $9 also, so again the total money supply exceeds the total debt by $100, the same as at the start.

If have $90 and then lend it to Fred, then I end up with an IOU worth $90, Fred gets $90 in cash plus a debt of $90. No net change in (money supply - debt).

No doubt, if people borrow faster than they repay, both debt and money supply go up. If they start to repay loans faster than they borrow, the money supply goes down.

What am I missing?

When folks say that debt and interest cause the money supply to increase and to increase faster than debt... is this some mathematical or accounting truth, or is it more a political or psychological reality - like indulging desire will increase that desire, like drinking salt water.

Any help appreciated!

Go to http://mises.org/Books/mysteryofbanking.pdf and download the PDF of "The Mystery of Banking" by Murry Rothbard. Go to the section on Fractional Reserve Banking on page 94.

==AC

What you're missing is your belief that: "I have $100, so the total money supply is $190. "

No. You don't have $100. You have a claim for $100. If you go to the bank and claim back what you believe (wrongly) is "your" $100, the bank may not have enough cash on hand to make good on your claim. When you make your claim (a recall) for the money back, that creates a debt. The bank then "owes" you $100. It doesn't mean the bank will pay that debt immediately. And as long as the bank doesn't clear that new debt, you do not "have" what you believe is "your" money. It's not your money. The bank owns it and holds it (well at least on their books).

I highly recommend that you watch Crash Course.

http://www.chrismartenson.com/crashcourse

It is well worth the time IMO. I really opened my eyes, perhaps it will do the same for you.

Cheers,

Debt in itself does not mean that debt always exceeds the money supply. Only if all money created is created from debt does debt always exceed the money supply.

In your scenario, that's what you're missing. The $100 you put in the bank, where did that come from? Did you borrow it from someone else? Did the government just print it? All money comes from somewhere.

Here's a more relevant scenario, taken from Economia by Geoff Davies, a book I strongly recommend you buy if you're interested in this sort of thing, how our money and economic systems encourage or discourage certain behaviour, and thus how they affect us and the natural world.

The village of Example has never had money before, then a young woman Avaricia who worked in a bank in the big city returns to Example, and tells them about money. She says,

"There are 10 families in this village. I will issue each family with $100 which you can use to buy and sell things. After one year, you must pay me the $100 back, and $10 on top of that as payment for my trouble in printing this money."

After a year, the Smiths had held onto their original $100, and earned more money by selling $100 of cows to the Jones, and $10 of cow manure to the Browns. So the Smiths have $210, they repay the $100 and the $10, and have $100 remaining. Avaricia tells them, "deposit that spare $100 with me, and a year from now I'll return it to you and give you $5 on top of it." This seems good to the Smiths and they agree.

The Jones had bought $100 of cows from the Smiths, and so at the end of the year had $0. Of course they slaughtered the cows and made jerky and leather out of them, but they couldn't find buyers - plenty of people wanted jerky and leather, but they didn't have enough money to buy them. Avaricia scolds the Jones for their laziness and incompetence and agrees to lend them another $110 to pay her back, but this time with a payment of another $20 on top of it - they're a bad credit risk, after all, she needs extra money to make up for that.

The problem was that while Avaricia created $1,100 of debt while only issuing $1,000 into circulation. There was no way that the $1,100 could ever be paid back in full because there was only $1,000 of cash floating around. Either everyone had to default a little bit on their debt, or some people do well and others are in trouble.

In the same way, in the US money is never simply printed. The US government never issues a dollar of currency, it issues a dollar of US Treasury bills, saying, "give us $100 for the Treasury bill, in one year we'll give you $5." The banks buy the Treasury bills and call them "assets", and then they themselves lend out money based on those assets. So the debt always exceeds the money supply. There's simply not enough cash to pay back everyone's debts, however hard the Jones work at producing stuff.

The debt exceeding the money supply also takes small differences in people's ability to handle their money and magnifies them. It creates a class of people who produce nothing and live off the interest on their money - the Smiths sell their cows and live off the money they lent to Avaricia. The people who produce a lot of stuff can never find enough buyers for it, and gradually become more and more in debt. Thus the rich-poor gap gets bigger between the Smiths and the Jones, between the idle and the productive.

If Avaricia charged no interest but simply issued a fresh $1,000 every year, then gradually the money supply would increase. Naturally the prices of everything would go up. This is called inflation, and is what Zimbabwe is facing.

If Avaricia issued $1,000 and then not any more, only replacing old and worn bills or coins, then there'd be a short burst of activity as people sought the new currency, but then things would decline. Because the currency is scarce, people would hoard it. People would then drop prices in an attempt to get more of this increasingly scarce currency, which would encourage people to not spend, since prices might drop in the future. But if people can't be paid for their production they stop producing. This is called a deflationary spiral, and is what the US is facing at the moment.

If Avaricia acted as an employer or warehouseperson and issued currency to those offering particular goods and services, and if the currency could be used to redeem goods or services from Avaricia's government and warehouse, that would encourage the production of those same goods and services. For example, if Avaricia paid $1 for a bushel of wheat, and if you could buy wheat for $1.05 a bushel from the warehouse, or buy a telephone connection from Avaricia for $2, then lots of people would grow wheat, buy telephone connections, and would accept that currency as a token.

In these simple stories you can see a lot of truths of modern world economies. Of course they are not the whole truth, but it gives you the idea.

Ah, I am starting to get the idea that the confusion is over the different types of money like M1, M2, etc.

It is very clear to me that the total debt can grow vastly beyond the total amount of cash.

An economy can be run just fine using checks or ATM cards. Cash just isn't necessary at all.

Or, one could run a huge economy with no checks at all, but just maybe a single coin or bill that everybody shares to settle all accounts. If I owe you $1000, I go to the bank and take out the one $1 bill in the world, and give it to you. Now I owe you $999. You deposit the $1. I go to the back and withdraw it. I give it to you again. Now I owe you $998. Etc. So a huge economy can be run with very little cash and no checks or ATM cards at all.

If A promises to pay to B an amount of X dollars in the future, then A has a debt of X and B has an asset of X. If we look at the total value of such debts and assets, they never get out of synch because of such borrowing/lending activity. Of course, other events may make them go out of synch. A person could go bankrupt and all their obligations dissolved, but people could keep trading their IOUs because they don't know about the bankruptcy. That makes the money supply get ahead of debt.

It might help to divide up two functions of money.

1) Money is a measure of value. We can manage the unit of measurement any way we like - tie it to some commodity or some basket of commodoties. It just makes trading a lot easier to have some common unit of measurement.

2) Money is a store of value. Of course, we can store value any way we like. One crucial question is how we want to manage the value of a promise. If promises can be traded or used as collateral for loans, then the usual multiplication of money can eaxily happen. Starting from 100 bushels of wheat, there can get created expectations to recieve 1000 bushels of wheat, along with promises to deliver 900 bushels of wheat.

When these functions get combined, it gets complicated. If I promise to give you next year something worth X units of value at next year's prices, then whoever controls the definition of the unit of value has a lot of power over me.

Actually, the issue of creating "money" was the topic of the novel, Gumption Island: A Fantasy of Coexistence by Felix Morely, 1956. Felix Morely was a Fed governor at the time. Like all good novels, an island is isolated from the rest of the country due to war. It's a good read if you find a copy. Be forewarned, however, that some sections are highly racist in their presentation. The book explains how they instituted a monetary system along with lots of other things. The book ends with a copy of The Constitution of Gumption Island.

Interestingly, I bought my copy, all those years ago, because it was reviewed by the WSJ. And, yes, it's still on my bookshelf.

Todd

I finally logged in to note all this wonderful work here for which i thank you all.

I have been in the oil biz, owned production, and follow all here very very closely.

This particular subject of money is my favorite, as I see it coming. The money dies.

Regarding what happens when the money dies, my favorite example is Argentina.

When they defaulted on their $160 Billion of debt, the banksters closed the banks and took all the cash, USD and pesos, and flew it out of the country. People were stoning and burning bank buildings.

The middle class was stopping the cattle trucks on the roads and killing all the cows to take meat home. Famous old quotes from folks on the streets were:

"There is no dollars, and no one wants pesos, so why not ink on toilet paper, we have a lot of that."