The Dollar, Euro, Peso, Yen, Pound in your pocket

Posted by nate hagens on February 1, 2009 - 9:34am in The Oil Drum: Campfire

If content is forthcoming from readers, the Campfire series will attempt to have Wednesday nights (US EST) highlight 'practical/local solutions' type essays and Saturday pm with 'what-if' big idea type content. If you have something appropriate, please email the editors at address on sidebar. Sharon Astyk on deck.

Executive Summary - The Money in Your Pocket

Jan. 30 (Bloomberg) -- "The steepest decline in Mexico’s peso in 13 years blindsided everyone", Jan. 29 (BBC) -- "Zimbabwe abandons its currency", Jan. 30 (BBC) -- "Wall Street has suffered its worst January on record". 30% of Iceland's population likely to emigrate. The US dollar and UK pound continuously lose value. On a daily basis the news clearly illuminates the San Andreas fault in modern economies - and yet nobody talks about the elephant in the room; are sovereign currencies such a good idea? If not, then what are the alternatives? Read on for a strong argument in favor of using modern peer-to-peer network technologies to implement something that addresses all the deficiencies of the money in your pocket.

The Dollar, Euro, Peso, Yen, Pound in your pocket

Preamble

Maybe it is true that money is the root of all evil. If so, then perhaps we should explore a new alternative that has the potential to negate the shortcomings of traditional money.One needs to consider currencies on a global scale and the implications of having so many currencies. In addition, one needs to be cognizant of the long term trends common to all currencies; over protracted periods they lose value and eventually cease to be. This is also true for currencies that are gold backed, note that the value of gold can swing wildly.

At the core of the following essay is the idea that if something can be traded then it's value can also be manipulated. It is important that you understand the concept of leveraged or highly geared trading using a margin account. In a nutshell, if the asset you are trading lacks liquidity then the gearing would be extremely low. For example, a house typically takes many weeks to sell (convert to cash) and has the lowest asset-liquidity of all. At the opposite end of the spectrum is cash itself in any currency.

If you were trading houses and you use your own fully-paid-for house as collateral, then you might be allowed to trade one-times or two-times the value of your house. When you are trading currencies the gearing might be over one-hundred-times collateral, this means for each $100 of your own money put into the trading account, you can trade $1,000. This type of leverage amplifies the potential to make a profit (or loss) on relatively small movements in exchange rates.

The majority of systems are dependent upon a set of variables whose initial states are random. Were you born in the tropics, the frozen north or a green and pleasant land? Perhaps you were born in a country with a lot of oil or other natural resources, precious metal or gem stone deposits. The variables are not conducive to harmony or finding long term equilibrium. The reality is that even if you are born in a land with oil you are unlikely to benefit as much as the corrupt ruling elite (Nigeria), or the monarchy (Saudi Arabia). Do you suppose the people of South Africa feel the wealth of their gold and diamond deposits has been distributed equitably?

In the grand scheme of things, money is just another variable, but it need not be so.

An international long term race to the bottom

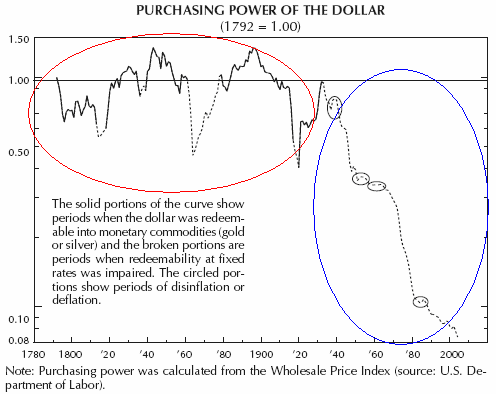

The following graphs are self explanatory, they are not all identical but the sentiment is clear, the purchasing power of the dollar has been unremittingly eroded:

The following chart shows the UK pound descend from a high of approximately $5

in 1915 to $1.36 today.

100 Year GBP to USD (Chart by Mike Todd, click chart for source).

If the dollar has fallen more than 90% in value since 1913 and the UK pound has gone from $5 to today's $1.36, then reative to the dollar it looks like the pound has fallen by a factor of 350 from its once lofty heights.

Admittedly the purchasing power of any currency cannot be considered in a

vacuum. One also needs to consider the increase in wages and the efficiencies

afforded by modern technology and manufacturing practices. However any increase

in wages etc. is likely offset by considerable increases in taxation and an

increase in the cost of living. The increase in the cost of living results

from, for example, new medical procedures that were impossible 100 years ago in

tandem with elevevated personal expectaions - 100 years ago a typical working

person might have aspired to own their own bicycle, these days it is a bloated

Sport Utility Vehicle (SUV).

Where we are today compared to 100 years ago is arguably irrelevant. A more

pertinent question might be, where could we be? It is much more difficult to

answer that question when money is a variable.

Sovereignty of currency carries a very heavy price and this price is

bankrupting the UK. Bear in mind that the US dollar itself has been in terminal

decline for the last 100 years and then you might see the dilemma unfolding in

the following five year chart of the British Pound against the US Dollar:

5 Year GBP to USD

The UK Pound has gone off the proverbial cliff. Consumer confidence is no

longer the correct attribute to measure. We should be measuring fear, for

surely this must be rising to a quick boil.

When a currency loses all value and hyperinflation ensues, the result is

extreme hunger for many and starvation for others. It is not written anywhere

that this only applies to countries like Zimbabwe. January 29 2009, Zimbabwe

officially abandons

its currency.

As a society we play fast and loose with a tool that should be one of the most

precious to us, not because it has any intrinsic value, but rather because of

its utility. Recognizing or negotiating a fair price is difficult if one day

your currency is a chicken and the next day it is a goat.

Since inception, governments have constantly tinkered with their (our)

currencies - pegging, unpegging, increased / decreased supply, gold backed,

free floating - and which is more apt free-floating or free-fall?

Why the need to constantly tinker? Because the absence of trade deficits and a

positive balance of payments are key to a countries long term economic

prosperity especially in a world where all countries are playing the game of

devalue-our-currency. It does not upset anyone when bread doubles in price, if

salaries have tripled. The game is up, for many years salaries have not kept up

with the rising prices stemming from the triple punch of currency devaluation,

natural resource depletion and over population.

Governments manipulate the value of their currencies by direct buying or selling on the international markets or by adjusting their interest rates. Iceland attracted consideable foreign investments by offering unsustainable interest rates above 10%. The net losses on [Iclandic bank] accounts opened in the UK and the Netherlands may exceed the Icelandic GDP. UK and Netherlandand governments are demanding that the Icelandic government repay a substantial portion of the losses. The likely outcome would be sovereign default.

Consider a situation where the UK wishes to devalue the pound to make UK exports cheaper, it chooses to do so by a combination of increasing the supply of pounds in circulation, thus diluting the value of those already present and also through the purchase of immense amounts of foreign currency in exchange for gold. One would expect the price of gold to slide or at least halt any increases. The foregin currency being purchased is however subject to upward price pressure. If the currency subject to upward price pressure is yours, then your governement would likely want to correct matters to ensure that the price of your exports are not adversely effected. If the UK chooses to sell its reserves of US dollars to acquire pounds, then this doubles the potential impact.

It quickly became apparent to governements that instability and endless adjustments are not deireable resulting in things like like the European Exchange Rate Mechanism. and ultimately the Euro. Alas there are still over 170 currencies to play with.

Governments of all persuasions do not restrict themselves to just tinkering

with currencies, they also manipulate key statistics. Unemployment figures no

longer count all of the unemployed, the criteria to be counted is constantly

changing. The determination of inflation is worse, the inclusion of

hedonics ought to be enough to convince any sane person that we now

live in a farce.

Inflation in the sense of increasing the money supply that is chasing a finite

supply of goods resulting in higher prices - is itself a grotesque abstract

contrivance and if you read further you will see that is is completely

unnecessary.

All countries fully understand the rules and are experts, unfortunately a

global consensus on how to stop the madness is unlikely to appear.

Motivation for Systemic Change

Cultural shifts - at an organizational level,

NASA learned that it is beneficial for Scientists and Engineers to be

using the same units of measurement and that internal competitiveness is not

better than internal cooperation. In New York on September 11, 2001, the

collapse of the

World Trade Towers resulted in the discovery that the CIA, FBI, NSA

etc. were also more likely to be competing than cooperating. There are numerous

cases where communication failures and lack of cooperation between social

services and police have had tragic consequences. In the west and especially in

the USA we live in a society where competitiveness is deeply ingrained at an

individual level and yet at an institutional level we expect the opposite.

It is profoundly unfortunate that it takes real disaster to spur the changes

that are critical and beneficial. For NASA it was the loss of space probes and

the loss of Challenger with all crew. For the USA national security agencies it

was the loss of the World Trade Towers in New York.

The magnitude of the current economic crisis combined with the sheer size and

number of institutions involved is more likely to lead to failure than the

discovery of the crucial changes that need to be made. Politicians run around

like headless chickens, temporarily abandoning their campaign for president,

while they rush back to Washington to deal with emergency bail outs, with the

mistaken belief that they can make political capital out of an Everest of

excrement.

We are being ripped off. This is especially the case for the last couple of

decades in the UK. A glance at the prices on the back of books, music CD's etc.

will invariably reveal that the price in GB pounds is remarkably similar to the

price in US dollars, despite the fact that the exchange rate for the majority

of the period was better than 2 to 1. The price difference for German made cars

purchased in Germany compared to the price in the UK was even more shocking, to

the extent that people were prepared to go to Germany to purchase a car and

arrange for it to be imported into the UK. Many people routinely made trips

into France and returned with their vehicles packed to the rafters with wine,

alcohol, cigarettes, etc.

Again we are being ripped off. The banks and most large corporations are

determined to screw us into the ground. How is it equitable that late payment

of a utility bill can result in an increase in the interest rate on ones credit

card? This state of affairs is intolerable with millions of people subject to

swingeing charges.

The institutions have failed us. In the USA the government, the Treasury, the

regulators (SEC etc.), the Federal Reserve System, The Office of the

Comptroller of the Currency - that is supposed to regulate the banking and

credit card industry - and the banks have all proved irrefutably that they are

either incapable or have no desire to represent the interests of the people.

The need for a stable predictable financial system is recognised by all. "What

our industry needs is first and foremost a functioning financial system," Tom

Enders Chief Executive officer of Airbus Industries

told the BBC at the January 2009 World Economic Forum.

There is little doubt that President Obama is likely to be one of the best

presidents ever to occupy the highest office. However it is much harder to

believe that in the time available it will be possible to move the entire

culture and philosophy of America to the place it needs to be. The challenge is

bigger than America, it is global. Presidents and Prime Ministers across the

globe will be too busy fighting fires. The United Nations is now completely

preoccupied with escalating humanitarian disasters. The only hope of a working

solution is if it comes from people across the entire planet.

Stability in Flawed Economies

Across the board, stability has long been recognized as desirable. January 23 2009, French President Nicolas Sarkozy called for fixed prices for multiple raw materials including crude oil. Stating that this is good for both producer and consumer. Fixed or stable prices, determined by some agreement or mechanism are all well and good, until someone figures out a way to game the system.Sarkozy could have transcended the simplistic recognition that stable prices for raw materials are desirable. It is equally desirable that prices of all commodities be stable, especially food, energy and shelter. It is lamentable that non discretionary spending for the majority should be exposed to the full force of a deeply flawed market economy.

For an example of 'deeply flawed', consider a recent change (October 2008) made by JP Morgan Chase Bank. As a service (their words not mine) to its credit card customers Chase reduced the grace period between statement creation and due date from 25 days to 20 days. There are three ways this reduced grace period could have been implemented:

- Move both dates closer to each other.

- Move the statement creation date closer to the due date.

- Move the due date closer to statement creation date.

There are probably millions of Chase customers that are paperless - everything is done on-line. As a software engineer, and web developer in particular, I know how easy it would have been for Chase to notify all [paperless] customers of the change to the grace period and also to obtain specific and unambiguously confirmed acknowledgment of the change. They did no such thing. The notice of change was at the bottom of the PDF version of a single monthly statement hidden in the small print under the staple. You should note that it is not necessary to view the PDF version of statements, since all information is accessible in the normal web pages. The collection of normal web site usage data would mean that Chase knew before hand the number of customers that regularly view the PDF version of statements.

It is likely that a substantial number of Chase customers that chose to be paperless were not adequately informed. Chase probably obtained in excess of $100 million fraudulently and a number of Chase customers likely transitioned from head above water to drowning. The banks screw us repeatedly and yet we bail them out instead of crucifying them.

Other examples of deep flaws would be enough to write a substantial book - the lack of integrity in ratings agencies, the inability or reluctance of regulators (SEC) to find anything wrong with Bernard Madoff after numerous investigations, the list could go on for a very long time. Who can possibly argue that there are not deep and profound systemic flaws?

There is one more banking example that has to be mentioned, it is identical in nature to Chase's behavior above. Many people will be familiar with this: An individual has $50 in their account, on the same day four checks are processed by the bank. The checks are for $55, $2, $2 and $7. Who can guess the order in which the bank will process the checks. Of course, by design, it is the largest check first, because that causes an overdraft and now all four checks can result in $100 or more of charges. Say again how banks have nothing but good will for their customers.

It would be impossible to regulate every contrived technique used by the banks and large corporations to "prevent" them taking advantage - it would be nice however if it was easier to prosecute them and make them think twice thereafter. The time for such niceties has passed. Prosecution is not supported by our paid-for representatives and institutions.

Stability continued

Many European Union countries, Italy, Spain, Portugal, Ireland, etc. are only able to maintain some semblance of normal civilization because they share a single currency that protects them against the vicissitudes of wild currency exchange rate swings.It would be bad enough if tinkering with the value of currencies was restricted to governments and central banks. Alas, we also need to consider professional gamblers such as George Soros.

In September of 1992 Soros made 1 billion in profit on a single deal because he bet successfully that the UK pound would need to leave the European Exchange Rate Mechanism (ERM). The bet that Soros made was so big that it manipulated the market and became self-fulfilling. There is something immoral about a system that allows one man to gamble and effectively take $30 in winnings from every man, woman and child in the UK. The UK Treasury estimated the cost of Black Wednesday in 1992 at £3.4 billion. Probably the Chancellor Lord Norman Lamont's worst day.

Lamont's announcement followed by talking head analysis

There are two ingredients at the heart of modern economic instability. The first is the existence of multiple currencies subject to the whims of authority and also the opportunity (through highly leveraged bets) for speculators like George Soros to pit one currency against another. The second, to a lesser extent, is a combination of offshore tax havens and the fact that it is not illegal to move money to these locations - the only reason it is legal is because the powers-that-be are the primary beneficiaries.

Possible Alternatives

What are the possible solutions? Perhaps curtailing the currency speculation simply by an international consensus banning it - but anyone familiar with financial derivatives and complex financial instruments knows that this is much easier said than done. Metaphorically speaking, the whole house would need to be pulled down and rebuilt. Any interaction with off-shore tax havens should simply be made illegal.A paper currency with integrated inflation that encourages liquidity - this is a Scrip currency possibly first concieved by Silvio Gesell I leave it to the reader to follow the links and familiarize themselves with this concept. This alternative shows how deeply ingrained and accepted inflation has become.

Local paper currencies - January 24 2009. The town of Lewes in the UK has reintroduced its own paper currency (BBC News Link). No doubt there have also been a few sales of high quality color printers associated with a new interest in high quality digital photography. The creation of local currencies is not the answer.

On-line virtual currencies - In some on-line games virtual currencies are beginning to gain social acceptance because of mass adoption. Unfortunately, in one case this is flawed because it is exchangeable with sovereign currencies resulting in some countries stating an interest in taxing transactions ( BBC News, November 2008, Sweden tax law clarification ). Perhaps this is a reflection of how truly desperate the situation really is.

A Better Alternative

The argument here is not for a single world wide currency in the sense of a traditional sovereign currency controlled by a central bank or group of central banks.Much better would be an international peer-to-peer network based virtual currency that lies outside the domain of any sovereign state - but most importantly this virtual currency must never have any physical manifestation and must never be convertible to or from any sovereign currency.

If a virtual currency cannot be converted into a physical currency and lies outside the domain of any sovereign state, then it cannot be subject to a King's tax - this is the catalyst that created an independent America in the first place and the corner stone on which all people should build. Civic infrastructure and government can still exist without income tax, sales tax and VAT.

A virtual currency gaining widespread international acceptance with no generally recognized and accepted mechanism to convert to or from a physical currency - may over time make physical currencies irrelevant. This will not please those people that have billions sitting in numbered Swiss bank accounts, nor will it please the Swiss people. It would also definitely not please George Soros or the executives of any bank.

How happy will the Marcos families or Robert Mugabes' of the world be, if their ill gotten gains are invalidated.

Countries and companies (De-Beers) that rely on either serendipity or monopoly for the creation of wealth may find the ground moving beneath them as precious metals and gems lose some consideration as a store of value. People should wear pretty things because the things are pretty, not because they pray at the altar of conspicuous consumption.

You might wonder how such a virtual peer-to-peer networked based international currency could get started, given that there is no way to exchange into the system from existing physical currencies.

The answer is simple. Everybody starts with a zero balance. Any transaction between two parties will result in an increment to one balance and a decrement to the other. This means that negative balances are totally normal, however the opportunity for an individual to create a negative balance and the amount is by mutual agreement of others in the network.

For example, a farmer wishes to employ some people to work in the fields. Assuming any positive, zero or negative starting balance - the farmer posts to the network a desire to employ people to work in the fields and the amount required. Others that have "community links" to the farmer on the network give permission for the facility, in effect an overdraft. In reality the farmer is free to use the facility to pay people working in the fields or to buy seed, fuel, fertilizer, animals, equipment, food, etc.

Transactions can originate from computers connected to the internet or from cell phones.

For cell phones the transactions could be performed by text message instructions or the use of applications running on smart cell phones. In Japan cell phones are already used for a considerable number of financial transactions ( DoCoMo financial transactions ). Each transaction would require two matching instructions and would be done in real-time. No more waiting several days for funds to be 'cleared' while the bank plays on the international markets with your money (and apparently at your risk).

Buyer / Seller

The buyer sends an instruction specifying the amount and the public identity of the seller's account. Example:"Pay 45 to HB", this could be abbreviated to "P 45 HB" or "P45HB".

The seller sends a matching complimentary instruction that also specifies the amount and the public identity of the buyer's account . Example:

"Receive 45 from XM", this could be abbreviated to "R 45 XM" or "R45XM".

When the system has received both instructions and successfully matched them to each other, then the transaction is performed immediately and a confirmation message is sent to both parties. Instructions not successfully matched after some [user determined] time will result in negative acknowledgments sent to both parties.

It may be insufficient for the system to rely solely on the senders cell phone number to identify the source of instructions, since Internet Protocol (IP) telephony can spoof a phone number. Whether IP telephony can be used to generate SMS messages is unclear. For example an SMS message originating from Yahoo Messenger or Windows Live Messenger does not appear to originate from a number that would be generally recognized as a phone number. This issue could be addressed by appending a predetermined Personal Identifying Number (PIN) or secret word to the end of the instruction. The use of an application running on a smart phone renders this issue moot.

The reliability of instruction matching for instructions originating from smart cell phones could be aided by assuming close temporal proximity.

Employer / Employee

The employer sends one instruction specifying the amount and the public identity of the other account to credit. The employee sends a matching complimentary instruction. The remainder of the process is the same as that above.Account Identities

Accounts would have a public identity that can only be used to increment the account and a private identity used for management of the account or querying account activity, balance, etc.Instruction Security

Using computers or smart cell phones that support the use of applications

provides the highest level of security. Plain text messages on cell phones are

less secure. Rudimentary research using Google indicates that SMS messages on

both GSM and CDMA

cell phone technologies are sent as plain text and it is possible for these to

be picked up over the air, or with ease by the telecommunication provider -

though (in the USA) in both cases a court authorized wire tap would be

required.

Acknowledgments could be sent as plain text if they are limited to "Transaction

succeeded".

Simply lobbying cell phone manufacturers to integrate encryption of sms text

messages is not a solution, since the encryption and decryption algorithms or

keys would need to be common to all cell phones i.e. public knowledge.

The other issue with cell phones that needs to be considered is cell phone cloning.

System Security : The Transparency / Privacy Balance

Obviously there are now some readers that are pondering how the system could be defrauded.One simple approach to reduce the potential for fraud, is complete transparency. If one stands in line at a super market and purchases haemorrhoid cream, then for most of us there is little expectation of privacy. In most countries it is a trivial matter for the authorities to peruse bank, credit card and phone data. When you are interviewed for a job, you may be asked what are your weaknesses and like sheep most of us will meekly inform our potential employer everything they could ever want to know.

The place for privacy is in your home, in your bathroom, in your bedroom and in your mind. The following is contentious, but why should knowing a persons salary or spending habits be considered an issue of significant personal privacy. Why should anonymous and uncaring bureaucrats know more about you than your friends and family. Would Eliot Spitzer, former Governor of New York state, have committed adultery with a prostitute if we all knew about it within a matter of minutes. Would there be potential to bribe high ranking officials if all transactions are transparent. Obviously bribes using physical gifts e.g. precious metals or a new car would still be possible, but you cannot put a new car in a Swiss bank account. How would executives salt away billions in offshore accounts if that is made irrelevant.

With regard to transparency, this does not need to be an all or nothing affair. If I am at a yard sale and wish to purchase something, then the seller will not likely be interested in my history and is only interested in not being cheated. Real-time clearance of transactions with immediate confirmation makes that possible and definitive.

Transparency could be controlled by the user. Entering into a significant economic relationship with another party might entail providing access to your transactions etc. People that choose to hide their transactions and suddenly appear to be living outside of their means would be subject to community query. We all effectively become the bankers, the financial police and the federal reserve, without any of the overhead or costs and obvious risks normally associated with such infrastructure.

Users should also be free to determine how long the system maintains a history of transactions - no history means no risk of audit. The corollary is that the account holder may be less trustworthy. People should be free to make their own choices and assessments.

With the option of anonymous transactions and no transaction history then there is no difference between a virtual currency and cash.

System Security : The Technology

An obvious requirement for a virtual system that is meant to be outside the domain of any sovereign state, is that it should not facilitate easy access by existing authorities. This pretty much is an opposite requirement to complete transparency.If I do not tell the authorities my unique network identity then the only way they 'might' be able to obtain it, is if they have someone inside the network that undertakes a transaction with me (and my account's public identity would not be of much value anyway). This automatically raises the cost to the authorities to the point that they would need extremely good reasons to go to such lengths. With millions of people in the network it becomes practically impossible for any authority to gather significant amounts of data.

Eavesdropping on electronic communications is easily protected against with encryption, and if the encryption key is unique to each individual or even each transaction then little is gained by authorities successfully decrypting a single transaction.

Authorities visiting a server location can also be addressed by partitioning, encrypting and distributing data. The partitioning of data can be thought of as slicing and dicing. It is a trivial matter to take a data table, think of them as fully populated spreadsheets, and slice the table into separate parts. The term often used in database parlance is vertical and / or horizontal partitioning. The addition of temporal partitioning, geographical dispersion and extreme normalization results in a database that is very difficult to recombine en-masse back into anything meaningful or useful. The addition of modern peer-to-peer networking would make it an exercise in futility.

It is also a trivial matter to limit or cap the number of inquiries that can come from a discrete node on a network. Simple traffic analysis can completely negate the attempt to extract data from multiple nodes concurrently - since we cannot be in two places at one time. If you can only see the universe through a pin hole, then you will not have much of a view.

The primary defense against intrusion is to create a moving and dynamic goal post. Make the effort to get into the system great and the reward negligible. As with all computer related security issues, the primary weakness is social in nature and not technical.

The use of anonymous pay-as-you-go cell phones would facilitate semi anonymous transactions - useful for criminals and the paranoid. Completely anonymous transactions could also be facilitated, if deemed necessary by a majority, through the use of one-time transaction numbers, akin to a single use credit card number. There are very few tools that have been created that do not offer both beneficial and nefarious uses.

In addition to all of the above, an international virtual currency on an international peer-to-peer network, need have no head office, and no central control - there is no head to cut off. The absence of a head is something that paralyzes authority. Oppressive regimes will likely try very hard to block all access to such a network - this would effectively be a case of selecting extreme self imposed isolation from the rest of the world.

The Benefits

Your virtual currency is international, you can visit another country and

nothing changes except perhaps local prices. You can know the real cost of a

hotel, food, taxis and the cost of living on the the other side of the planet

in terms that you use on an everyday basis. Wave goodbye to exchange rates and

multiple charges by Bureau de Change, also wave goodbye to international ATM

charges and ATM's. A virtual currency would also be ideal for on-line payments

of any magnitude - wave goodbye to PayPal and wave goodbye to the hidden 3%

charge included in the price for credit card payments. People that think the

absence of interest or annual charges signifies a free credit card are sadly

mistaken - if you cease to use a credit card for all transactions then it

becomes free.

Families dispersed across many countries would never have to consider sending

money home - since the same currency is shared across borders and moving money

between accounts is a trivial matter (free of wire-transfer charges and

complications). Wave goodbye to Western Union and Money Gram.

There are many countries like the Philippines where opening a bank account is a

luxury for a wealthy minority and many members of families regularly send money

home to parents. The fact that Western Union has a de facto monopoly and the

Philippines government does nothing about it, is nothing short of criminal.

People that are already relatively poor, pay 10% commission to Western Union to

send money home, how can this be acceptable to anyone?

Opening an account should not be the preserve of the well endowed or fortunate.

Anti-money laundering requirements in the UK mean that you cannot open a bank

account without a utility bill, even a passport is not sufficient - it has

become truly absurd.

Would it be nice if you controlled the savings you have in the bank? You get to

decide if your savings are available for loan to others and the terms. If you

decide not to make any of your savings available to others, then there is no

risk to you, therefore there is no need for any insurance. There is no bank

that can become insolvent or suffer a 'liquidity' crisis.

If there is no physical bank, then there are also no bank charges and no

executives rewarding themselves with your money. If negative balances are as

common place as positive balances, then the notion of an overdraft is invalid,

as are the fees and charges associated with such.

Bad checks and check fraud are confined to history.

If there is no physical bank, then there can be no run on a bank. No fat cats

sitting in ivory towers, no private jet, no luxury yacht. If the financial

gurus of the world want to get rich they will need more meaningful jobs -

surgeon or farmer springs to mind.

For too long, banks have been able to get away with immoral charges that are

definitively disproportionate to the actual underlying cost of any service. The

charges are, more often than not, capricious and egregious, only if someone is

prepared to kick up a sufficient fuss is there the possibility of a refund. The

UK has seen

significant recent legal challenges brought against banks and their

charges.

This essay describes how it is possible to start again. To render credit card

banks irrelevant. To make credit scores redundant. An end to identity theft and

the idea that you are defined by your social security number, your date of

birth and your mother's maiden name. We should be defined by who we are, not

the result of a calculation by a ratings agency.

International trade is simplified. Goods on the slowest boat from China will

not change value while they are in transit. It is no longer necessary for

international traders to hedge against currency fluctuations since they no

longer exist.

International trade dependent on letters of credit becomes a thing of the past.

Finaly, it is impossible to counterfeit a virtual currency.

The Biggest Benefit - Absolute Stability

In addition to lacking the infrastructure, burdens, costs and risks of a physical currency, another benefit of an international virtual peer-to-peer network based currency that has no exchange mechanism - is that it cannot change value, it cannot appreciate or depreciate, it is not subject to inflation, deflation, stagflation or speculation. It cannot be manipulated by the change of an interest rate nor diluted by an increase in the speed of the printing press. The net amount in virtual circulation is always zero. It cannot be traded or manipulated by authority. In the truest sense possible it would be a fiat currency that belonged to the people. Stability is an entirely reasonable expectation, it should not cost the Earth - it should be a right!If the deal of social security, retirement and pensions is nothing more than a fraud, then it is time to start again from scratch and cut out the evil cancer at the heart of modern economics.

If the future is one where localization is a predominant factor in a post peak oil world, then a stable virtual currency is a foundation on which to maintain communities. Communities that desire to build or maintain civic infrastructure can still do so - the difference is that the funds will be given (by mutual agreement) as opposed to taken. The world's biggest and most convoluted tax code - rest in peace.

The Cost

Expressed in US dollars at today's value and based on the assumption of complete adoption, the cost to develop and maintain the software would be less than 1 cent per annum per user. Developed as open source software (the preference) the cost would fall closer to zero in relative terms.Hardware and operational costs are largely distributed to the user base itself, since it is a peer-to-peer network, and as such these costs are deemed too negligible to warrant further elaboration.

Entry level hardware requirement for a user could be reduced to a (shared) smart cell phone or use of a computer in an internet cafe, that is, if computers in an internet cafe can be trusted not to have virus or key logging software. This would mean that people in the third world would not be excluded. See above for issues relating to the encryption of SMS messages. The hope would be that the cost of smart cell phones can drop considerably. If encrypting the text message instructions is not deemed critical then the minimum entry level cost drops to the price of the cheapest cell phone.

Obstacles

In the USA, the biggest obstacle would be the screams from authority about the loss of the US dollar as the worlds de facto trading currency - this would be a lie since in reality they are much more concerned about anything that might undermine their wealth, authority and power over you. The rest of the world may soon be screaming louder.The only other obstacle is you.

Conclusion

This essay is not comprehensive and is not meant to detail every eventuality. For example there is no mention of individuals or businesses creating multiple accounts and attempting to game the system. These issues and numerous other social issues can also be readily addressed but describing everything in depth here would be too great a task.One final thought. A virtual currency that cannot change in value should be reflected in very long term stable prices and ought to be the perfect compliment to a steady-state sustainable economy. People will be able to save for some kind of retirement with a degree of certainty about the future price of bread or their favorite indulgence.

Hyperinflation for the USA looms on the immediate horizon. Business as usual is no longer a choice. China recently made the Yuan an international currency that can be used for trading and held in reserves. Will the Chinese Yuan supplant the US dollar as the preferred international currency?

It would be interesting to see if others see any merit in the system described above. My hope is that the foregoing will strike the majority as a spirited, compelling and cogent argument in favor of something radically new.

It is time to start again. Thank you for reading. If anybody cares to translate this essay into French, Spanish, German, Tagalog, etc. then please feel free to do so.

The Author

Houston Brennan is a cyclist, accomplished tri-athlete (IronMan), a gentleman, a scholar and an acrobat.He is also an independent software engineer and technologist with more than two decades of experience, currently specializing in multilingual Microsoft Dot-Net database web development.

Previous clients include Lehman Brothers (Prime Broker), The London Stock Exchange, Coca-Cola, United States Department of the Interior (BLM) and miscellaneous others.

His world wide public account identity is HB.

File Reference: \\LP1\Deepend\Houston\Misc\IVC 3.xml (ideal virtual currency).

January 25 2009.

I see many, many problems with this. Electronic gold, 100% backed by gold deposits would be a much better option.

By the way, the balance would not stay zero very long. Almost instantly, you would have people with negative balances defaulting, driving the balance above zero. Also, what happens when someone at negative 1,000,000 dies?

If gold goes from $500 to $1,000 an ounce, then your exports have just doubled in price. If you counter by selling a significant portion of your gold reserves then you have to either re-state the relationship between the currency you still have in circulation and your gold reserves, or you need to reduce the currency in circulation to maintain parity with your gold reserves. Classic economics says less money in circulation should lead to less demand for goods and lowered prices (deflation).

If my understanding is completely wrong, then please enlighten me.

Why so? Have you made the assumption that a negative balance is a debt or liability of some kind? A loan from some other person would be a debt that one might choose to default on, and the community would get to decide what happens in that situation.

Another social issue - so basically you (the community) get to decide the answer.

Does the person that dies with a balance of negative 1 million own a farm, a business or any substantial assets, or did the community provide that facility so the person could smoke expensive cigars and support a gambling habit? The answer largely determines the options that are available.

The opposite question is also equally valid - if a person with a positive 1 million balance dies, then what happens to it? The issue of positive or negative should be irrelevant, do not think of one as an asset and the other as a liability.

If ordinarily a negative balance is associated with an employer, then their ought be a going concern, assets, land etc. that could be sold. If positive balances can be passed on through inheritance then so should negative.

This is a social issue not a technical one and besides the notion of 'net currency in circulation is always zero' is academic. There is no 'money supply' in the traditional economic sense.

On the subject of bankruptcy and defaulting - I firmly believe that in the past money supply was manipulated; initially made plentiful to encourage credit and growth and periodically withdrawn, making credit difficult to obtain and resulting in economic crashes.

Economic crashes are characterized my massive multiple concurrent bankruptcies. A consequence of concurrent bankruptcies is that assets are less likely to reflect a meaningful value - farms and homes purchased for pennies on the dollar.

A currency with absolute stability should firstly reduce the uncertainty that leads to bankruptcies and secondly reduce the likelihood of massive multiple concurrent bankruptcies, thereby reducing the likelihood that assets will be available for pennies on the dollar. If the doomers (and I am one) are correct, any asset that has been shipped some distance, for example farm equipment, may be difficult to obtain and consequently maintain or increase in value. For sure, the disposable consumer society is fast coming to an end.

Ummmm... no, for the time being that's not the way it works. Dead persons executor (a gov't appointee if dead person had not provided otherwise) will take control of the estate, must first pay contracted debts in fiat currency, and disburse the balance if any according to the provisions of the will, or if there is none according to a formula to dead persons relatives, or if they had none, then the state will take it. If 'the community' attempts otherwise police should at some point prevent them, using force if necessary.

Now since the units of exchange in this barter system have been defined as having no fiat currency value, else the virtual currency would be defacto exchangeable I can't see how it can be valued in an estate, or a "debt" or "property" in a valid will, any balance outstanding would need to die with the person it seems to me

If you have a currency backed by gold and you cannot create credit out of thin air, gold cannot go from 500 to 1000. That's the point, you can't create money if you have to back it with something.

What the heck else could it be?

That's a hell of a way to create generations of debt slaves. If your dad dies owing 1 million, are you going to volunteer to pay it back? Better yet, since this is community currency, you can work to pay back your neighbors negative 1 million.

Thanks but no thanks.

We may be arguing at cross-purposes. Please clarify the following for me.

How does your gold backed currency work:

Is it the only currency or are there other currencies?

Can it be exchanged for the other currencies?

Would your physical gold be shipped to/from other countries in settlement of foreign trade?

If so, what happens when:

Regarding negative balances. No these are not debts in the conventional sense, they are not subject to interest and are not repaid. When an entity with a negative balance receives payments the negative balance will tend back to zero and become neutralized. Hence my stating "The net amount in virtual circulation is always zero". The community (or if you can only think in these terms - the state) gives permission to create a negative balance and also controls the magnitude. This is akin to currency creation and scarcity is facilitated by the P2P market (see the post by imofftoseethewizard below).

Debts that need to be repaid and should be considered liabilities, are loans from other people or businesses. A positive or negative balance is not a reflection of a persons indebtedness.

If the currency is 100% backed by a physical commodity (e.g. gold, silver), the supply of which does not fluctuate wildly(not a lot of gold is being created or destroyed very quickly) and everybody uses that commodity, how does the price go from $500/oz to $1000/oz on any short time scale unless someone feels the need for that much more gold and is willing to exchange products or services for it. If that person paid with currency for the gold, well...the currency is effectively gold, so you could only have as much gold as you had currency unless you had other real things with which to trade.

The price of gold can change so quickly today because of the enormous leverage allowed by a fiat currency existing in a fractional-reserve monetary system (where you can lend other people's money without their consent --- but they can still take it back at any time via bank runs). In any system not backed by something real the wealth you've earned your entire life can go poof in an instant and there is nothing you can do about it (kinda like what's going on right now).

Your two references to 'unless' partially answers your own question.

It is difficult to address the scenario you describe when it is laden with so much ambiguity. You say "the currency", but you do not say if the scenario is a universal single currency backed by a precious metal. Why do you suppose I requested a clarification above?

"everybody uses that commodity" - is that because everybody is sharing a single currency?

If I am to answer your question in this post, then I am forced to make assumptions, these are they: it is a single universal currency backed by gold and any other uses of gold are not relevant.

Thus to answer your question how could the price of gold change: If one of the countries happens to have substantial reserves of gold and discovers they have substantial deposits of platinum, they may decide to switch to a platinum backed currency and sell all the gold. Do you suppose selling all the gold reinforces stability or undermines it?

A gold backed currency for a single universal currency does not work because the whole world becomes highly motivated to acquire gold and on top of this what happens if a country discovers it is sitting on top of a uniquely desirable commodity (say a new highly portable energy source) - over time a substantial portion of the gold moves its way to their bank vaults and this adversely affects the other currencies in circulation. Also, it makes no difference if the other currencies are the same currency or different currencies that are also gold backed. A countries wealth cannot be measured or tied to the amount of gold held in its vaults.

You cannot have countries that are currently using over 170 currencies all switch to a common precious metal backed currency, even if it were a mix of metals, because the price of the metals would instantly start to climb, even at the hint of such a move.

We live in a finite world with finite resources, if the sum of all currencies were bound in some way to the precious metals, mineral deposits, fisheries, forests and clean water supplies then this would still beg the question 'what happens to the sum of all wealth if a country discovers or invents some new commodity that is unique to them but incredibly desirable'? And also, what is the effect of an expanding global population - surely an expanding population with a finite 'sum of all currencies' is unfair?

For me, the argument that currency should be only a medium of exchange and have zero intrinsic value is overwhelming.

I agree with this 100%. It is not just the price of gold that can change quickly, it is everything. The fractional-reserve monetary system is nothing more than a fraud. In my opinion, money 'loaned into existence with interest' should be considered treason.

Ok, so maybe that response had a few caveats...

The problem is, as you say, that currency's only function should be to serve as a medium of exchange. What we have now, and have had for many periods in the past, is that our currency is not stable enough to warrant much confidence and what's worse, our authorities think they can "stabilize" it when in fact they are probably doing the opposite (ever get the gains wrong on an inverted pendulum controller? :P ).

We need to remove this illegitimate and fraudulent monopoly on money, and be able to take ideas like yours and see if they actually work.

Houston, we have a problem, or at least I do. How is the credit worthiness of users determined without the local knowledge option you started with, and to expand how are the initial units generated and their universal value determined? I don't see this happening without a central data base which would somehow guarantee the constant unit value of the basic debit/credit unit. No monetary system no matter how universal and digital or local and shell based will function without the faith of all users in the value of the monetary unit, the more constant the value the higher degree and the more universal the distribution of that faith.

A lot of the nuts and bolts of how the transaction work don't look much different than a single currency universal debit/credit card that has different information levels transmitted to all users as agreed to by the users would. The type of interface (phone, computer, fax, teletype whatever) has no real bearing on constitution of the system but rather on its convenience to the users. It appears to me, as I have already indicated, someone or network of someones must be maintaining a database the make all these transactions possible, simple point to point transactions would be barter without a centrally guaranteed and tracked value unit. I am sure this is exactly what the big banks have as the ultimate goal of their credit card system now, as maintainers of the data base they would get a cut on every transaction. If some new entities maintained the database, they would be the bank, to imagine the all important database function done for free flies in the face of all that has come before and we haven't changed since before. I am sure I must be missing some critical element here.

The scrip link was excellent. Thanks

Hi Luke,

You could ask exactly the same question of all the people that sell things on eBay, how did they acquire 'reputations' or 'trustworthiness'. There is no reason that a P2P system should be any different in regard to establishing credit worthiness. Would you prefer wholesale import from Experian, Equifax, Transunion etc. or maybe start again from scratch.

In addition, I am making many assumptions about the nature of society in a post peak world. Everything is going to be localized, community relationships will once again be important. People will actually have to save in order to buy things and not rely on credit. I think credit ratings as we perceive them today will become a thing of the past.

This is an excellent question. Initial values could be copied from prices that we see today. I don't think there should necessarily be single static universal prices on things. It is the currency that has a fixed value of zero. Everything else is dynamic and reflects local demand and availability. The network could provide information about historical prices and / or prices in the neighborhood.

A database can be comprised of multiple smaller databases and geographically dispersed - the distinction between centralized or decentralized is academic. From a user's perspective it would look and behave like a centralized database even though it is not.

By definition a fiat currency cannot work without faith. It may be that the system needs to earn that faith. I agree that "the more constant the value" then the higher degree of faith. A currency that cannot be exchanged ought to be pretty stable.

I agree completely - my going to town on transaction details and interface was probably not worth the effort. It was easy to anticipate some of the replies that have appeared but not others. In retrospect I should have put more effort into describing how the system could have started, grown and acquired trust. The benefit of hindsight.

P2P networks for file-sharing are great for publishing large media files and distributing the load to many computers. But I have yet to see the killer P2P application - in my opinion it is obviously a virtual bank supporting a virtual currency. The Linux operating system and Open Office give you a measure of how significant systems can be developed and they can be free. If enough people clamor for a P2P virtual bank with a virtual currency, the likelihood is that it would happen, depending upon where society is at that point in the collapse.

I agree with you in regard to the goal of the big banks - my preference is to either deny them further opportunity to screw us all to death, or at the very least diminish the scope.

Yes the start up is the real issue I was raising. I agree basic assumptions on the big post PO picture starting point are critical to how any monetary system would go forward. I don't see it getting as local as many do, but that is strictly my opinion. Developing scenarios for moving forward from any number of post PO starting points (which likely will exist in different locales at different times) does seem a sensible approach to the unknown.

You rail on regards the iniquities of the current system, how it is set up to benefit the rich, but believe that would stand?

Snowflakes chance in hell.

A new law, bringing such things within purview of the revenue would be passed within days.

There would be no new law necessary in Canada. Income and sales taxes are deemed payable on facilitated barter transactions, (of which this proposed system is one similar in many ways to the LETS system, though much less realistic it seems to me) at fair market value of the goods or services involved, already.

Sorry to have to join in on the party raining on your parade, but the problem with currencies are not that they aren't virtual enough--the problem is that they are already too virtual, too made up, too fiat.

We need to start tying currencies to the real world in some tangible way, not further de-link them from any last shred of tangibility (hard currency).

I don't know if this means a gold standard, silver, oil, some basket of energy fuels, or something else. But many of the problems we have gotten ourselves into rise IMVHO from our ability to infinitely multiply debt (or assets) in a finite world.

We have to reconnect with our finititude (to coin a word) rather than try to continue our mad dash away from it.

Just my two virtual cents.

(By the way, a virtual currency would not be of much use to those excluded from the computerized world. It would obviously be most beneficial to those most familiar with computers and how to manipulate them. Not too surprising that such a proposal should come from someone with your background.)

As far as I'm aware, all major currencies are fiat.

For a Steady State Economy it would seem necessary that money is tied to something that is a real asset, such as gold, ie, to put an end to destructive economic growth of the debt creation cycle.

Currency has no intrinsic value, it is just a promise to pay. Real assets are reflected by their notional value in a currency, so currency would still be volatile depending on the supply and demand of what the fiat currency is intending to buy.

If existing currencies truly have no value, then why do they have constantly changing exchange rates? By and large the same commodities (real assets) are being sold into all markets, so I do not agree that supply and demand of commodities is a major influence on the value of currencies in general.

My argument is that playing around with the supply of a currency is undesirable, the result is a change in value of the currency and either inflation or deflation.

It is bad enough that the price of commodities should change because of supply and demand. Having a currency that can also change value just compounds the volatility.

A currency's value is a reflection of goods, services and ability to pay debts. The volatility is created as the market reacts rationally and emotionally to information about a countries performance, e.g selling off on bad news and rebeounds when something is perceived as oversold, the £ appears to be going through a temporary rebound.

Russia was a major exporter of a real asset - oil. The rouble has come under enormous strain and been 'revalued' since the collapse in the oil market. A reference here

Currencies do therefore change according to supply or demand of their their underlying assets.

Currency is a reflection of the value of the economy its being used in, and there's no way around some agreed to medium being required to act as a guide to determine valuation. Consequently, we don't need to recreate the monetary system, we simply need to be better stewards by maintaining regulations. Regulations put in place originally during the last depression, that for some Republican reason were abandoned to make way for as many homeowners as possible, with no thought as to the eventual consequence of that action.

We should know enough about the economy by now to set certain regulations in stone and keep them there! Stop thinking there are ways to make ever more money by getting around the system, but instead embrace the idea of a monetary system that is so stable you can hardly notice the difference from year to year. Lock it in and only make minor adjustments to the interest rate from there.

This is a good idea, and has been around in different forms for a while. Unfortunately, no government will allow it, at least that is until after the hyperinflation sets in and destroys most world currencies.

Look at Ron Paul’s attempts to restore constitutional money. The redistributionists want fiat money in order to confiscate wealth. Interest on savings is below the rate of inflation, even before taxes.

The public somehow understands this and that is a secondary factor in the debt binge and the negative savings rate. (The primary factors being wages not keeping up with actual [not as reported] inflation due to decreasing productivity and the ageing population).

Economists do not understand the production and distribution system. They have an incomplete understanding of energy, engineering and computer systems and how scientific discovery and innovation are drivers of economic growth. We are in the final stages of implementing the 18th and 19th Century understanding of the forces of nature, primarily thermodynamics and electromagnetic theory, which led to the productivity miracle and almost all features of our modern standard of living. To achieve growth we need to exploit the 20th Century technologies, nuclear energy and biotechnology. But it is hard for me to see how these can equal the impact of electrification, especially because of the decline in resource quality that will require increasing amounts of energy to keep us supplied with all mineral resources.

Income tax should be abolished. It is a disincentive to work, especially for two earner households. It also encorages debt to purchase assets that are expected to keep up with inflation while their interest is tax deductible. The government encouraged us to become insolvent!

We need a consumption tax that everyone will pay, including those in the shadow economy who work for cash. The most heavily taxed items should be those we import, such as oil. This will dramatically reduce the trade deficit and reduce our risk of supply interruptions caused by acts of war or terrorism. These imports are unsustainable in the long run and will eventually result in the collapse of our society.

The fiat money system is set to collapse due to the amount of money printed to bail out the world’s economies. The proposed economic stimulus package will not lead to growth, only to more debt. Not enough is being spent on transportation, nuclear energy and energy conservation. The Jubilee will be through hyperinflation.

I am in agreement with Dmitry Orlov, author of “Reinventing Collapse”, which is pertinent to the financial crisis and a must read by the CIA, our military and our political leaders, both Democrat and Republican.

I think the period where currencies are a depository of wealth is over, and currencies will become only mediums of exchange and, in some limited manner, commodities.

The virtual creation of wealth is a concept and economic model that is no longer practical in the mass extinction.

"I think the period where currencies are a depository of wealth is over,..."

I agree 100% however IMO 99% of the conflict we will experience over the next peroid (yeah "next peroid" is a cop-out term but I have no clue as to time frame) will center on this exact issue.

It's all about protecting wealth right now and mulititudes will die because of it.

Even editors here admit they will not give up their hard won gains.

We are truely and completely Fragged. Yes it is over but not in a good way.

I am not particularly intuitive, but my feeling is that the period of collapse has already started (obviously), it will be shockingly short (not measured in years) and the opportunity for a controlled and orderly transition will be minimal.

Pretty soon there is likely to be an exodus of funds from IRA's, 401k's and so on. When that starts there will be no 'return'. Some people with hard cash will realize that it is potentially an enormous liability and choose to spend it as fast as possible - stocking up on food, tools, fuel, gold, silver, anything. Some people may choose to ramp their credit cards to maximum with no intention of paying it back.

A dramatic increase in demand for 'survival assets' will undoubtedly lead to price increases. Hands up, anybody that thinks people behave like sheep.

If Bush was still in office, the mounting panic would be palpable. President Obama has probably brought us a small delay.

Hey Houston, did Lehmann brothers pay you in mortgage backed securities? Or possibly company stock.

The history of money:

4000BC the Lydians invent coinage.

3999BC the Lydians invent clipped coins that don't actually have as much silver as they say they do.

+1

Is +1 for the witty and cynical history of money, or the question of how Lehman Brothers paid me?

"Fixed or stable prices, determined by some agreement or mechanism are all well and good, until someone figures out a way to game the system."

Not to mention it angers the people producing those goods, yet who have to buy other goods not fixed. An excellent example is the National Energy Program introduced by Pierre Trudeau to shelter eastern Canadian consumers (and voters) at the expense of Alberta (see the entry in Wikipedia for details). Even today, decades later, Albertans still get angry at the recollection of it. If it didn't even work for a single Canadian province, it isn't going to work on a global basis.

Virtual currencies WILL be gamed. The hackers will be highly motivated.

Authorities can already track e-mails through anonymizers or establish connections between two individuals by traffic analysis, even if done from multiple addresses (and which is used in court as proof of criminal intent).

Barter and LETS currencies are taxable in Canada. It's too much trouble for Revenue Canada to track yard sales but if the transactions were done by computer, then it is easy enough to monitor them a la Echelon.

Here is a really interesting (but technical) post on the relation of fiat money to a debt based economy (hint: central bank money creation is swamped by bank debt creation)

Really worth a look!

http://www.debtdeflation.com/blogs/

Computers and computer networks allow us to cope with more complex (and hopefully more optimal) arrangements. Remember airline ticketing before the Internet. For money in a post-growth world I think we can support multiple currencies with different advantages. I like 2 ideas:

1. Money backed by real stuff. Whatever you chose then gets stockpiled. So gold is a silly choice. The right answer is to back it by a mix of non-perishable things that would be useful to have a stockpile of.

2. Gail's suggestion of basing money on tradeable ration cards (for essential consumables) is naturally complementary. It is also a valuable democratization of wealth in a world where the rich have commandeered a huge fraction of the world's wealth, without "lifting all boats" as promised.

My vote goes to the eMergy.

This is based on the unit of available energy.

It is reflected in nature as the struggle for Adenosine triphosphate

http://en.wikipedia.org/wiki/Adenosine_triphosphate

http://dieoff.org/page170.htm

It would undescore the central role of energy in everything real.

I also believe it is inevitable.

It will be used by whatever replaces us. (the Son of Man).

See you on the other side.

"Sorry Mr Taxman, I just don't seem to have any emergy today."

The scariest thing about electronic money, including the entire banking system, is its vulnerability to electromagnetic pulses form nuclear explosions, or at least so I've heard.

http://www.globalsecurity.org/military/library/report/1996/apjemp.htm

Perhaps someone here can verify this.

EMP from air-burst or outside the atmosphere detonation would likely destroy significant portions of any electrical grid, telephone network and so on.

Optically isolated computers can be protected using Faraday cages. I would not be too concerned about electronic currencies if you are within a few hundred miles and downwind of a nuclear bomb going off.

I am sorry. I missed something. If everyone starts with $0, and can spend money, even if they have $0 in their account, what is the point? How does money under this system in any way represent wealth? Or what does it represent?

The 'money' would have zero intrinsic value. The absolute wealth represented by a balance is impossible to determine because it cannot be exchanged. The notion of a currency having implicit value (that can be manipulated) is one of the reasons, in my opinion, that we are in such deep crap. Peak oil, peak energy, peak everything, over population, declining resources, etc. are some of the other reasons.

There would be two ways that you could gain money:

If you're going to quote scripture, do so accurately:

1 Timothy 6:10 says "For the love of money is a root of all kinds of evil."

This is a lot more powerful statement than one that ascribes values like evil to inanimate objects.

Things that behave like money have certain properties: the are durable, transferable, portable, fungible, and scarce. These enable them to act as tokens representing things of value.

Your proposal devolves durability to the underlying system. That's a solved problem.

Your proposal, by being entirely abstract, allows easy transfers, obviates the need for portability, and is trivially fungible.

Scarcity, however, is the crucial downfall.

Suppose there is no enforcement of prices. If I agree with you to do a service -- e.g., weed your garden for a hour -- and in return you agree to credit me with 1. I may use this as my standard rate with a number of other people and acquire 40 credits by the end of a week. If in Harare, another pair of people had come to a similar agreement, but with the price being 10 billion credits per hour, then the other weeder would have 400 billion credits at the end of a week. Roughly speaking the other weeder and I have done equivalent work, but my recompense is negligible in comparison. In short, your proposal does not provide me a store of value; the 40 that I earned has no persistent power to persuade others to grant their time or goods to me.

Suppose, on the other hand, that there is an enforcement of prices. Either it is a centralized system -- with all of the attendant difficulties of a centralized system setting prices -- or it is a collectively negotiated system. The first, I expect, would look a lot like Soviet communism. Collectively negotiated systems, in general, are markets. If I wanted to bid on a service, I might borrow from you 1 credit or 1 billion credits with which to bid; the sum is still zero, yet without some limit on borrowing, prices can not be limited.

In essence, your proposal describes a system where every actor is a lender of infinite leverage, zero cost of carry, and no need to be solvent.

Not entirely. Firstly I agree that the system would need to encompass some kind of market that facilitates pricing. I do not necessarily think that a market would need to have centralized control like a stock exchange. A P2P market could readily support transparency and immediate access to latest prices to promote a level playing field.

I admit I am less clear on how to robustly implement scarcity. In my mind I can see two sources of borrowing, though I am loathe to use that label for one of them:

The first is loans from people or businesses that have accrued positive balances - these are automatically scarce, since not all people will likely be able to make all of their money available for loans. These would be perceived as conventional loans and are provided on terms determined by the source.

The second is the business or person that requests the ability to create a negative balance from the community - I am loathe to consider this a loan, since it need not be subject to either repayment nor interest. The obvious issue is how to limit the negative balances to foster scarcity. The weakness is a social one - how to ensure that a community does not "issue money" with reckless abandon. It ought to be possible to use a market to limit the ability of communities to issue money and at this point everyone is thinking T-Bills, Treasury, Federal Reserve, M1, M2 etc.

Suppose the system has a global limit on the sum of all negative balances. That would place a corresponding limit on the sum of all positive balances.

It would leave open the question of what that sum should be....

Exactly and I am open to suggestion. A simplistic approach would be to consider the sum of all things that could ever be traded, commodities through to art collections. Total them up, multiply by some arbitrary number, say 100 and there it is.

Or, if you are into Hitchhiker's Guide to the Galaxy, then it could be 42 x 10^12

The actual number should be of academic interest only and issues might be, should it change in proportion to the stock of things that can be traded, or should it change in proportion to the size of the population, or some function of both, neither, something else altogether.

I think that those are important considerations. Population, certainly. I can't see any reason why that number shouldn't be directly proportional to the number of users. The rest is a bit of a head bender: how do we measure the stock of things that can be traded? We make, break, grow, and consume myriad items every day. Given innovation, fads, changes in taste, it's something that would need to be constantly renewed. I doubt there is an analytic or even computationally feasible solution to that. It might be better to find a way to gauge whether it was too big or too small, and then tweak it accordingly.

And speaking of that, who would do the tweaking? Would there be some central administrator?

That is both a social and political issue - my preferred solution would be by the system itself. Multiple requests on the network to increase the number would be like energy introduced into a system that can oscillate. When the requests die away, the system would slowly reduce the number. Ideally the function that translates the requests would implement something that resulted in critical damping.

The lack of a common standard for pricing is indeed the mayor weakness to use a system like this beyond a village community. This can only work if a personal relation exists before the monetary transaction. If there is none, we're back on square one with a similar system to that of today, with regionally differring values of products and the need for impersonal control mechanisms.

I don't see neither Marx nor Lips mentioned in this thread.

Liquidity, money, cash, capital are different categories.

The relations of these are in sense of topology a structure. A structure is the totality of relations invariant to a class of transformations.

This is necessary and sufficient to understand quantitatively the "problems" of fiat money, and also of gold backed currencies.

One has to define Markov chains and Markov vectors to get to a dynamic theory

of value at risk of all asset classes.

That's not easy but since you have the

variables and their interdependencies at once, so to speak, you have a model that

forecasts the "fate" of fiat money precisely.

I feel a need to clarify the 'negative balance is not a debt' thing.

Imagine there are only two people in the system, you and me. You are a farmer and I am a farm worker. At the start we both have zero balances.

It is spring and you decide you want to plant some potatoes. You go to the network and check the market rate for farm workers and see that it is 10 per hour. You know that it takes 40 hours to plant your field, so you place a request on the network to create a negative balance of 400.

I am the only other person on the network and I have the necessary community links to allow you to create a negative balance of up to -400. You recruit me to do the work and after 40 hours you pay me 400. I now have a positive balance of 400 and you have a balance of -400.

The potatoes grow and we do not kill each other. In order to eat, I have to buy potatoes from you. As each week goes by I buy potatoes and my balance reduces to zero at the same time that yours does.

The negative balance is not a loan. It is not subject to interest and does not get repaid - it is neutralized by payments from others. The ability to create or maintain a negative balance is analogous to the creation of currency or money supply.

I have two main concerns.

Firstly:

In principle, I am a supporter of LETS-like currencies, so you should know I'm not just questioning/critiquing to be spiteful. Having said that, however, I think that you may need to clarify your definition of "community," as I wonder who this supposed community is who will allow you to create a negative balance in the first place? This is particularly important if we are talking about a system used by millions or tens of millions of people.