Peak Jubilee

Posted by nate hagens on July 19, 2009 - 10:56am in The Oil Drum: Campfire

Energy procurement from this point forward will be inextricably linked with the state of our financial system. We need energy to grow...we need debt to initiate new energy projects, and we need growth to payoff debt. We also sit amidst a mountain of debt, are passed the global peak in cheap oil production, and live in an environment where not only is the gap between the haves and have nots accelerating, but so is a general awareness of this gap. With this backdrop there has been increasing talk about a 'get-out-of-debt-free' holiday sometime in the future, a debt jubilee of sorts. At the root of debt forgiveness are two issues central to our energy future: - 1) the disconnect between biophysical and non-resource-based accounting and 2) the favoring, via government rule changes, of one social group versus another (in this case, creditors vs. debtors).

Tonight's Campfire questions revolve around the implications of debt forgiveness for energy and social stability.

Jubilee n. A season or an occasion of joyful celebration

Debt Jubilee===> In 1997, Jubilee 2000 was created in an effort to deal with the problem of oppressive debt in developing countries. It is named for the Jubilee year found in the book of Leviticus, when enslaved peoples were freed from their debts, their lost lands restored, and the inequalities that were suffered, removed. Organizers of the original Jubilee drew similarities between international debt and historical enslavement.

I am of the opinion that the credit explosion of the last 3 decades was a social response to the receding horizons of natural resource availability/affordability per average person (median not mean). Debt and credit enabled a large % of society to maintain positional goods consumption in the face of flat real earnings and increased energy imports. As such, global peak oil is a symptom, not cause of the credit crisis, though $150 oil definitely pricked the bubble. As has been discussed on this channel for many years, we are surrounded by all kinds of solar based energy flows, but modern infrastructure is wholly dependent, at least in the short/intermediate term, on oil: extremely cheap, transportable great distances in liquid form, and incredibly energy dense. Combined with natural gas and coal, this high energy gain (EROI X scale X flow rate) trifecta has subsidized/powered modern civilization to its current level of complexity and infrastructure. It stands to reason that if we did have the ability to procure 90 million+ barrels of such oil at a $10-$15 cost for another few decades, our current debt crisis might gradually be ameliorated by similar forces that brought us here, namely energy gain, technology, and iterations.

But we are now on a treadmill with time in the form of public/private interest payments and funding needs for hungry mouths (municipal projects, hospitals, infrastructure maintenance and repair, etc.) Debt, and the ensuing interest payments it engenders, set in motion two dynamics at nearly all hierarchical levels of society: 1) over time, the leveraged paper money system causes a widening gap between real capital and the financial markers most of us 'believe' in and 2)over time, the debt/credit demographics favor increasing flows from poor to wealthy, both at individual and national levels. The end of growth is not the only implication arising from this set of conditions - policymakers will likely find themselves between a large rock and a very hard place, with writing off peoples/countries debts becoming a more and more tenable possibility, as improbable as it now sounds.

Debt forgiveness is not a new concept, with literary references as far back as Leviticus (Bible). More recently, the 1980s and 1990s saw many third world countries have their 'Brady Bond' debt renegotiated for pennies on the dollar. Post 2000 examples include Argentina and more recently Iceland. In the past few months Haiti and Liberia have seen their debts forgiven. On a micro level, the ability to file for personal bankruptcy is now being expanded to policies such as mortgage debt forgiveness for those in negative equity situations, etc. It has not yet happened that entire classes of personal debt are written off: if/when it did one could envision that those who used debt to buy wind turbines, educations or electric vehicles might experience a jubilee before speed boat or AR-15 buyers

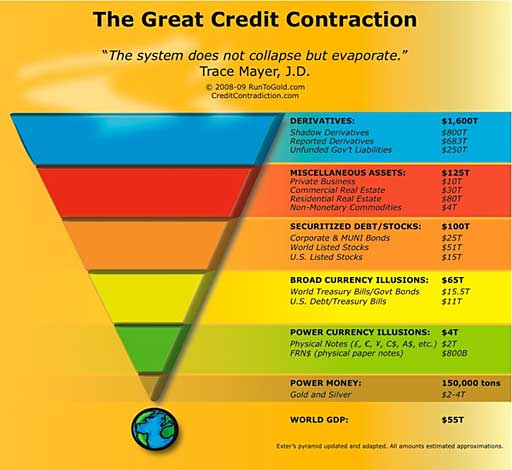

Source: The Great Credit Contraction

Though debt forgiveness is not new, a debt jubilee on any meaningful scale combined with the (potentially) quadrillion+ of notional IOUs at a time in history when our energy hemoglobin is starting to run through clogged arteries, suggests a socially unprecedented event. Attempting to inflate away our debts will likely only be taken so far, the inflection point being reached when the risks of permanent loss of seignorage outweigh the benefits of printing. I agree with Gregor MacDonald* that the US will first try to persuade other countries to stimulate/inflate at a faster pace than we do - a modern day spin on beggar-thy-neighbor. But the end game (pre-overtime) will probably be some form of debt forgiveness, yet another in an increasingly long set of choices between the lesser of two short-term evils without thought for any long term plan. Ironically, both the creation and ultimate repudiation of debt, will have occurred so that certain demographics could maintain the semblance of equality.

An impartial observer might view Earths social situation circa 2009 with relative unconcern. We have amazing technology, an abundance of natural resources (still), and low basic needs, based on throughput requirements. But (a)decision-makers are not impartial and are for the most part among the 'haves', (b) our perception of 'needs' is in reality very close to 'wants' (+ we have a prevalence of addiction, formal or otherwise) and (c) the within and between country wealth disparity is at record (modern) levels.

On an absolute basis, everyone (in aggregate) would be better off if debt was wiped clean and we started afresh, perhaps tethered to reality via some kind of energy/natural resource based currency. But certain individuals/regions/nations will resent any debt forgiveness en masse, especially those who played by old school rules and did not participate in the past decades orgy of easy credit. If this trajectory comes to pass, it will reward those who lived beyond their means. As TOD regular 'Greenish' would say, this will cause our 'capuchin fairness meters' to go haywire. If the tide goes out on all boats equally, (or roughly equally), I think you'll see peoples cooperative, rather than competitive drives, dominate. If jubilee is only for a few, there will be blood.

It is an open question what happens when the 21st century version of the Prodigal Son returns home. I expect his brother to have similar, though leveraged, reaction.

Peak Jubilee is not here yet. But it's coming.

The Scarlet Debtor

Campfire Questions:

1. How likely is a 'debt jubilee', either between countries, or between internal classes of creditors within say, the United States?

2. Following a mass debt forgiveness holiday, would it be the former debtors, or former creditors (or neither) that might be viewed with a social stigma?

3. What would the implications for energy production be following a debt jubilee?

4. Is there any workable path between the two poles of debt forgiveness and eventual inflating away debt through printing/stimulus?

As usual, I don't have answers to the above questions, and there probably aren't any. The hope is that via discussing them, the benefits and drawbacks of various options might be better understood. If not, the discussion is probably still better than watching TV...;-)

Well, in lieu of complete debt forgiveness why not just give every tax payer an amount of fresh fiat currency.

Just to pick an arbitrary method...........how about linking it to the amount of tax the individual paid over their lifetime.

I know it has many more moving parts than that but at least everyone gets a benefit and not just the prodigal sons and daughters.

I have no debt and have always paid the debt that I have incurred. I lived much differently than the squandering fools over the years and I resent wholly any get out of debt free card at my expense.

Talk about a moral hazard!!!!!

Having said my peace I do think that the system is rigged to fleece the have nots by the haves and that is what needs attention. I just don't think it is fair at all to penalize prudence.

1) If the prudent individuals are not compensated in some way it will destroy the fabric of an already tattered and fragile society.

2) I think even at this point it is plain to see that the creditors are usurious vampires with no moral conscience what so ever so they are already stigmatized. Former debtors that get off the hook will be hard to indentify "socially". I mean walking down the street I can't tell who is up to their eyeballs in hock plus they are in the majority.

3)Everything will ramp economically including oil production..........this is not a long term desirable.

4)I don't think that inflation is going to work. The US economy is a hollowed out shell with hardly any meaningful occupations.

All Americans do is borrow and buy. Until we re-industrialize and produce nothing will matter.

porge,

You say:

Yep, it really sucks! However, whether you accept it or not if you are a part of US society you are by definition *NOT* debt free. You, like everyone else has been complicit in the incurring of a massive energy based debt, which is now reflected in our national debt. You owe, you owe, so off to work you go! :-)

Link

Six Syllables to a Savage Truth also found on PriudentBear.com

by Stewart DoughertyJuly 16, 2009

"...The cost of the government's financial-crisis-related bailouts and guarantees currently exceeds $13,500,000,000,000.00, which is 200 times larger than the Madoff scandal. And the nation's unfunded contingent liabilities, for programs such as Social Security, Medicare, Medicaid, government pensions and the like stand at $75,000,000,000,000.00, 1,150 times larger than Madoff's fraud....

Of course, these numbers make laughable the government's righteous indignation and shocked disbelief that a "Ponzi scheme!" as "large" as Madoff's could have operated in the United States. The government's response is a textbook example of the intelligence industry's attention-diverting technique known as misdirection.

In June, 2009, the Congressional Budget Office (CBO), a government entity, issued its "Long Term Budget Outlook" for the period 2010 through 2080. The executive summary begins with these words: "Under current law, the federal budget is on an unsustainable path – meaning that federal debt will continue to grow much faster than the economy over the long run."...

The United States has already reached the point where it is arithmetically impossible for it to pay its debts or keep its promises, unless it devalues its currency to the point where it impoverishes its citizens and creates international financial chaos. And even devaluation as a means of ending the country's budget nightmare will be difficult, given that so many government programs have cost-of-living escalators, making inflation a “No Exit” horror story. This is not subjective opinion, but rather objective, arithmetic fact, now supported even by government agencies themselves, such as the CBO. As John Williams of shadowstats.com has observed, even if personal incomes were taxed at 100%, the United States still could not pay its bills....

Even more astonishingly, on June 26, 2009, in the midst of America's employment and economic meltdown, Congress approved $108,000,000,000.00 in loan-guarantee funding for the International Monetary Fund (IMF), so the IMF can provide financial assistance to "poorer nations." No citizens on earth are as indebted as Americans, given the nation's $11,500,000,000,000.00 federal debt, and more than $85,000,000,000,000.00 of combined federal debt and unfunded contingent liabilities.

The IMF funding is in ADDITION to the government's June 26, 2009, $106,000,000,000.00 supplemental war appropriations bill, which was supposedly meant to pay for continuing military operations in Iraq and Afghanistan, but which includes U.S. taxpayer gifts of $660,000,000.00 for Gaza, $555,000,000.00 for Israel, $310,000,000.00 for Egypt, $300,000,000.00 for Jordan, $420,000,000.00 for Mexico, and $889,000,000.00 for the United Nations, for so-called "peacekeeping" missions. War is peace. Orwell must be laughing himself sick, six feet under.

Congress is in such massive denial about the fiscal and financial crisis it has already created that its spending orgy continues without restraint. In fact, the out-of-control spending is now so outrageous that one can seriously argue that Congress, the Treasury and the Federal Reserve (Fed) are deliberately trying to destroy the United States....

Arnold Toynbee wrote, "An autopsy of history would show that all great nations commit suicide." This is exactly what we are witnessing today in the United States: fiscal and economic suicide. As America's "leadership" injects financial poison into the country's veins, the citizens stand by and watch, having not a clue about what to do to stop the destruction. Today's unavoidable reality is that tens of millions of American citizens are going to die financially before they die physically, thanks to government losses and crony payoffs that enrich and empower a small, shameless, greed-stricken minority at the expense of the entire nation....

Despite the CBO's calm outline of the next seven decades' worth of ceaseless, staggering American operating losses and surging debt, we are fast approaching endgame...."

I think the government is insane in letting the big Banks pay bonuses to management as losses were socialized by Paulsen and Bernanke. Fed loan to these banks at effective 0% is another subsidy. Even a less than astute company could make billions with direct government support. The bonuses allow the banks to avoid taxes and would give employees a "stock recovery" that we don't get.

Please drop the cent zeroes, they make it harder to read the orders of magnitude.

Hi Magnus,

I first had the same objection myself, but the reason for the zeroes is explained in an editorial note to the original article in prudentbear.com:

I think Magnus meant the zeros to the right of the decimal point. These are just noise and prevent someone from sensing the magnitude. If anything, they work the other way and perhaps magnify the dollar amount. This may be intentional.

Exactly.

If you want these numer to be understandable for most people you could divide them with the population. $11,500,000,000,000 federal debt is harder to understand then 37,000 dollar per individual.

Those of you above are proving what Newman is saying about being distracted. You are nitpicking and failing to step up to the plate by doing such.

The cents is that distracting to you? Come on..please. The numbers are staggering. The cents issue it meaningless.

This is a fault I see in TOD...Total nitpickyness in the extreme.

Sorry but your posts are soooo obvious.

Airdale

Hi Newman and all;

Yesterday while waiting for my sport viewing opiate, I happened to catch some of Australia Network's 'Inside Business". There was some barking brain being interviewed imploring, almost hysterically, that people should stop talking about the financial crisis, because it is over. I almost reached into the fridge for an early beer.

porge says

'Well, in lieu of complete debt forgiveness why not just give every tax payer an amount of fresh fiat currency.'

michael panzer of

http://www.financialarmageddon.com/

see in right column parts 1-4 of 'when giants fall'

he believes at some point the gov./fed will bow to political pressures, & print via sending us debit cards- pick a no. he says. big nos. as hyperinflation hits & we can't buy necessities; as nate says- endgame[don't know fully the meaning.] i believe this can't last long.

michael predicted deflation; probably some more, & i think his thinking rings true of then to inflation.

1. so my above drags the system along a little while; $20,000 debit card, pay that mortgage if it gets bigger, etc. debt jubilee via debit card.

2.those living like porge.... pissed; they probably got paid for guns too.

3.nationalization is the short, eventual answer.

4.see above post. endgame few months at best.

try global currency then or they will at an earlier point. it will fail. Wad of bills; then barter for a while.

Interesting post, Nate.

My take on it is that a new approach to Equity (I was intrigued to see Taleb advocating this in the FT the other day) will actually make debt obsolete.

The current position is that credit - in the form of IOUs issued by credit intermediaries - has been monetised. That is to say, that we assign value to something which is the exact opposite -a claim over value. Emissions trading and carbon credits are the same - the political attribution of value to something intrinsically worthless.

Now, >97% of this bank money=credit is interest-bearing - and dated. ie there is a repayment date.

The balance <3% of this money is not interest-bearing, and is undated ie notes and coin.

This undated money is "redeemable". It used to be redeemable for something of value ie gold - but that ended in 1971 and now a note is just redeemable for....errr....another note.

I advocate the creation and issue by energy producers of Units redeemable for value or "money's worth". In particular I advocate Units redeemable for electricity - and for as long as carbon-based fuels are in use - in such fuels.

Moreover, it is also possible to create Units which are redeemable for the right to occupy location. Almost two thirds of money ever created came into existence as mortgage loans ie it is credit issued by credit intermediaries and backed by location/land rental value.

Whatever the basis of the Units, transactions may take place by reference to a Unit of measure or "Value Standard" consisting of a unit of energy. The result of this is, as I posted here before, a form of Energy Accounting, but with far more value in circulation than just energy.

As I said here

REIT Way to solve the Credit Crunch

there is IMHO quite a simple solution to the Credit Crunch, and that is to create Pools of affordable rentals and unitise them into what are essentially REITs where the units are redeemable for the right to occupy land/location.

And as I said at the recent All Energy show in Aberdeen

Supergrid - Energy Pool

the Unitisation and forward sale of renewable energy and energy savings enables us to fund the massive investments needed. This is because issuers of Units are receiving value now in return for Units they issue which will cost them nothing to redeem in the future.

The outcome of what is essentially a Debt/Equity swap on a large scale could be seen as a form of Jubilee. It leads to forms of money based upon value and which give us credit which is not so much "debt-free" (debt is the flip side of credit) but what I may term "date free".

I believe that a new networked financial architecture

Money 3.0

is capable of spreading virally, firstly because its consensual nature (a partnership framework) means no legislation is necessary, and secondly because it benefits from the "Cooperative Advantage" of not having to pay returns to purely financial investors.

We may turn neoclassical MSM rhetoric on its head. In a P2P world there is simply no need for "unproductive" rentier shareholders for investment, while for credit - as Gilmore (almost) put it - "the Internet interprets Banks as damage and routes around them".

I believe there will be a debt jubilee,both on a national and global scale.But it won't be in any sense be by consensus or organized.It will be a global scale mess as a result of economic and resource meltdown and it will not play out well for the reasons outlined in the article.

If the current ruling hierarchy can't get their act together on virtually any scale as amply demonstrated so far then how could they possibly negotiate a solution to the debt crisis?

Pigs might fly.I think this fundamentally answers questions 1 to 4.

I've got to agree with you thirra. Debt relief is not an "if" question, but a "when" question. It's going to happen because the exponential growth in debt cannot be repaid, no way, no how. And with how our world governments don't deal with any pressing bad news until way after anything can be done about it, those holding the debt are toast. Therefore, it really is an advantage to hold onto real assets, and keep deferring any accounting of what is due until much later in time. Possession of tangible assets is 9/10ths of the law, and when TSHTF, you pretty much will own it outright. I forsee land & real estate to revert to whomever is squatting upon it when TSHTF. There will be too much other really bad stuff for what remains of law enforcement and the military to try to quell.

This whole situation has me replaying in my head The Dead Kennedys' "California Uber Alles" & "We've got a bigger problem now":

Last call for alcohol.

Last call for your freedom of speech.

Drink up. Happy hour is now enforced by law.

Don't forget our house special, it's called a Trickie Dickie Screwdriver.

It's got one part Jack Daniels, two parts purple Kool-Aid,

and a jigger of formaldehyde from the jar with Hitler's brain in it we got in the back storeroom.

Happy trails to you. Happy trails to you.

Yeah, that's it. Just relax.

Have another drink, few more pretzels, little more MSG.

Turn on those Dallas Cowboys on your TV.

Lock your doors. Close your mind.

It's time for the two-minute warning....

As a voluntary political choice, this seems even less likely than an actual revolution, given the feudal calcification of the entire system. It could probably happen only in the context of some such upheaval.

Still, I can't imagine any sane person thinks the public debt, entitlements, or a significant portion of private debt is ever going to be paid off. This can't even be serviced for much longer.

I think the debt jubilee will simply be imposed by history when the system can't take it anymore, and we have hyperinflation or federal default, at which point the dollar will collapse and all existing debt will be forcibly jubileed.

It seems there's no social stigma left at all for anything other than child molestation. No one has any authority to try to bestow shame, and no one is capable of feeling shame, for anything. It's part of America's complete moral collapse, which is certainly related to the bubbles and financial collapse.

There is one exception. While none among the wealth and power elites feel any shame at all over being history's worst thieves and beggars, there are still many among the non-rich who carry this as a kind of brainwashing, who still feel a need to pay their debts to the banks who preyed upon them even as those same banks default on their own debts, receive massive bailouts, and take pleasure in committing this second round of fraud.

The reason the banks are refusing to lend right now is because they, better than their political waterboys and bagmen, recognize that the global economy is insolvent and "growth" is finished.

I imagine a debt jubilee would tend to confirm this perception for them. So energy projects which have to be privately capitalized through yet more zombie debt, after all the old zombie debt was just jubileed, aren't going to get that capitalization.

Will Western governments finally see the light, that it was deranged to put energy production in private hands in the first place?

Well, if they could call a debt jubilee, anything is possible.

No. America is insolvent now, held up as a zombie debtor by helpless creditors; there has been no real growth in over ten years, only debt-bubbled fictional growth; the productive base is hollowed out; America has no reality-based way to produce again, to provide the dollar with any basis, and all the fairy-tale ways seem to have run out. (Reflate the housing bubble? A new carbon bubble? Those don't look promising. Anyway, any new bubble would not be a "workable path", but just a way to prop up the zombie for a few more staggering steps.)

What he said...

Since the vast majority of money IS debt, a repudiation of debt is the destruction of money.

Actually, the opposite happens. Debt issuance creates money with an 'expiry date'. As it is repaid it ceases to exist, but during the term of the loan it circulates and is exchangable for real money.

When a borrower defaults or a debt is forgiven, that money remains in circulation permanently, so the result is inflation, and all other money (including other debts) is devalued.

This is in fact a good motive for governments to forgive debt. If they directly print money by selling treasury bonds to the central banks, this is rightly seen by other holders of government debt as a way of abbrogating previous debt. If governments forgive un-repayable debt, it can be passed off as good social policy, but achieves the same result.

Well, that does make a lot of sense.

You have a future in politics. Now work on accepting grift and you're a shoe in.

No, seriously I think your keen insight makes the forgiveness more plausible than I first thought.

pithy

my teeth hurt

In the late 70's, central ND, farmland sold for $500/acre. The value of the land was at best worth $300/acre from the standpoint of crop production.

Farmers were going bankrupt in the early 80's. But the best the banks could do is get $300/acre if they foreclosed. So there was as program to just write down the loans by the banks. Many thought it was not fair, but it was generally accepted as best for the farm community.

The unfairness in the debt system is the fact that the banks get to just flick a pen and own the farmers future.

The people fight with each other never looking at the real problem...........the usurious banking system.

Nate,

You mention the prodigal son.

The other 2 parables of Lent are

The parable of the lost sheep.

The parable of the lost coin

Maybe there is something behind the Bible after all !!!

white men, maybe vellum?

I don't get it.

I got it.

If everything were to be put in a great pot and shared out equally that would be a true jubilee and while I think many of us here have greater than the average amount to put into that pot, we would still all be wealthier for it.

In the meantime, Nate, you put me in a great dilemma with that prospect of a possible debt Jubilee ordinaire. What is it I should do, stay in cash or use it to take out a mortgage on a castle in Spain?

If you can get the mortgage take it and then you can put granite counter tops and travertine tile in the front foyer for a quick flip on the castle.

Oh wait, that was last years scam. sorry.

Given that this is a thought experiment and not necessarily an ideological stance, here goes:

Rather than an across the board debt repudiation, how about a permanent interest 'jubilee'. All principle is still owed. The implications for different kinds of debt [long term vs short term, private vs public, personal vs corporate, debtor vs creditor etc] will play out differently. This shouldn't be a one-off event because we are hoping to restructure the economic system to accomodate the expected shrinkage economy. It would be a way of doing business with the deflationary expectation built in. It is the reverse of the current 'discount rate' where money now is worth more than money tomorrow.

Given that no matter whether we keep the same system we have or drastically change someones ox will get gored. The question is whose ox will be gored the worse.

Vicky

I think this post talks about an important issue. There is no way that all of the debt outstanding can be paid back with interest. Somehow, the whole system is going to come apart--probably not nicely.

The fact that there are not enough underlying assets means that there are going to be some that are going to be left out in the cold.

One thought that occurs to me--why favor debtors or creditors? If the whole system is unsustainable, a change in government is likely as part of working out a new system. A new government could, at least theoretically, start over. It could announce that all assets will be distributed to the people, regardless of prior ownership. Large farms will be broken up so everyone gets a share. Businesses will be given to co-operatives operated by the workers. The new leaders of government will get the big houses (paid for or not).

Of course, those who own their own homes and farms would be unhappy, but ultimately another part of what is unsustainable is the concentration of wealth in the hands of the few.

Another approach would be that the new government would own all the land, and the people would rent from the government.

Realistically, one should attempt to determine how Goldman Sachs would like this untenable situation resolved (I realize the power structure is not simply Goldman, but they are a good proxy)-at this point their preferred solution would have to be considered the most likely outcome IMO.

If Goldman gets their way I fully expect it to be outrageously unfair and that may be the spark that lights the many brush fires in the minds of the sheep.

Hi Brian, Goldman would love it. When I said above that everything should be put in a big pot and divided equally I had forgotten Goldman and the likes would be in there like dropping bricks to start monetizing our bits and then divesting us of them. Sorry, I was a fool, it won't work. Guns knives, broken beer bottles and struggles in the night are the only answer.

Gail, I enjoy your posts and your comments often make me think and reconsider my understanding of my view of a topic, but your post here actually motivated me to convert from lurker to 1st time poster! Funny what that says about how people are motivated or at least me.

I think your thoughts(musings? since they seem off the cuff) and other posters with similar posts in this thread here are simply bad and have been proven by the past century to be horribly bad.

Humans have tried communal ownership of property and we've discovered that they are more destructive (lives and the environment) than market orientated political economic systems, and they actually killed more people than all of the wars in the last century.

Ours is not a good system, its simply the best one we (people) have created so far. Look at North Korea, one of the last communal systems out there and ask yourself if that is a system that you would like to live in.

There are no do-overs, but there can and will be revolutions and civil wars. I am afraid if we were to actually try your suggestion, we would end up with one or the other or both. A bigger fear that the response would have us end up in a totalitarian fascist type state, which to me is just the flipside of a communism. I am hopeful that we can do better and not play that coin.

What we won't do it seems currently, is actually do something to change the course we are on. ** Not until the pain of not changing is as bad if not worse than the pain of not changing will we begin to deal with the problems and find a better path. ** I wish it were not so, but except for a few individuals (many of the posters here it appears), are not accepting reality and won't until it bites.

Nate, interesting post. To respond to your questions, I think there will continue to be small scale debt forgiveness between countries of the core and the gap (to use Thomas PM Barnett's paradigm), within the US I think it will depend on how willing we are to bend our current laws, and if the debtors in question are considered systemically important or not (compare what happened to Lehman vs IndyMac vs GM vs CIT - think how much fates are determined by individual players vs rules-laws).

I think there will be plenty of social stigma to go around, who gets to pin the tail on the donkey is TBD, will it be like the French Revolution, the Russian Revolution, Germany/Italy in the 30's or something else?

If we are to keep some semblance of our current system, the only way out is through time and the printing press (inflation) I think. We are still deflating and it remains to be seen if they will be able to patch the balloon to be able to reinflate it. Will it work? Only if people do not suffer such an acute threshold of pain, that they coalesce around people and ideas that allowed the events in the previous paragraph.

I do enjoy the campfire, thanks for another log tonite!

Thanks for un-lurking!

I am not saying that these ideas are necessarily what will happen, or what should happen, just that if there are major changes in the monetary system, there are often major governmental changes at the same time. These changes quite often are more than new elected officials. They may involve new national boundaries (think fall of the Soviet Union), and may involve a totally different type of government--possibly fascist or communist or something else we haven't thought of. It is possible that the new leaders will think that what they are doing is for the best of the people, since our current factory farms may not continue to work long term.

When I talk about the government owning the land, I understand that this form of land ownership has been used in China and in some other countries. People might be assigned particular areas to live on, they just wouldn't "own" the land. If they move, the land would go back to the government.

It depends what you mean by "ownership".

IMHO no-one should have absolute exclusive rights of Commons (such as location, non-renewables, and knowledge) - Period. Indigenous peoples such as native americans have difficulty understanding how anyone could even claim to "own" land: other cultures assert that absolute ownership is God's alone.

Exclusive rights of use, on the other hand are essential, but I take the position - with Henry George - that those who have the privilege of exclusive rights of use of such Commons should compensate those they exclude. In other words, I advocate taxes on privilege - and the unearned rents that derive from it - as opposed to taxes on people and particularly on earned income.

The innovation I have been working on is a new approach to ownership through the application of partnership-based legal and financial agreements - as opposed to protocols imposed by statute or judge made.

Here in Scotland we recognise three verdicts: Guilty; Not Guilty and "Not Proven" and it is in this third non-Absolute space that the answer lies, I think.

Why should not Land be held in Common by a "Custodian" - with veto power, but no positive control - and then the use value or production shared in agreed proportions between the user of the land/location and any investor of "money's worth" (eg labour, bricks and mortar, fertiliser).

In a nutshell I am proposing

Pages 8 and 9

a new form of "Co-ownership" and a market which operates co-operatively on a "Not for Loss" basis of shared surplus.

If there is to be a State, then it should be a participative State IMHO, in which all Citizens are members, rather than a Jacobin State, from which citizens are alienated.

Gengis Kahn was right. Civilisation sucks.

All this nonsense about who owns the land. No-one owns the land.

Try and claim the land and we will book you with an appointment with Mr. Darwin.

How to keep our culture is the problem.

Someone told me that only 2.5% of money exists in reality. The rest is digits on a computer. A typical smoke and mirrors trick by the Master Illusionist.

Time to wake up folks.

Not quite sure what Mr Darwin has to do with this but I agree that no-one owns the land.

http://www.n55.dk/MANUALS/DISCUSSIONS/N55_TEXTS/AB_LAND.html

http://www.n55.dk/MANUALS/LAND/LAND.html

Good luck with handling "tragedy of the commons" withouth land ownership.

Distributed land ownership has been central for Sweden not developing serfdom

during the middle ages and it it is still working for motiviating people to do

multi generational investments. I advocate more individual ownership to get

better husbandry of resources, not less or vage ownership.

40 acres and a mule.

The total surface of the earth is 57.5 million square miles of land, which includes major deserts, Antartica and many other areas that for multitudes of reasons are for all purposes uninhabitable.

The current population of the earth is approximately 6.7 billion.

If you divide the total land area by the total population you get: 0.00862 square miles per person, That's approximately 5.5 acres per person.

So if you take the total available land and completely stop all population growth you get about 5.5 acres of land for each human being.

If you'd like to do the numbers for usable productive land by all means do so but I think just by looking at the numbers I've come up with I think we can begin to see a problem.

So since it's no secret what percentage of people own the usable land one could say that there is no such thing as human rights.

I personally think that this is a really big problem.

And khmer rouge style piles of dead bodies.

I guess we are all gaining an appreciation for Damocles.

All my life i have tried to ignore the fact that I will inevitably die. It is getting harder and harder to do that.

Yet you're the guy who just said this:

So just for the record while I still have a few Swedish friends left ( I really do), are you saying that you are supporting the side of the Khmer Rouge types?

Maybe it's not to late for me to reconnect with my Mongolian and Hun ancestors and lose my squeamishness about playing polo with the heads of my enemies a'la Atilla the Hun, eh? Oh yeah, the other part of my ancestry is Danish, I'll guess I'll have to dig up some old Viking skills as well...

Then again being a rich landowner doesn't rule out death by plague and pestilence which might be a consequence of messing up the commons. Sow and yea shall reap!

Shall we negotiate a new paradigm or just go to all out war?

I would withouth doubt go to all out war to protect social structures that has worked for a very long time and those structures ability to togeather with a large heritage of infrastructure and other capital produce large ammounts of food and post peak oil usefull goods. My intetion is to as far as I can better and grow this isle of prosperity and spread the prosperity via trade wich is a mechanism that is more robust then aid.

Dividing all these owned assets and giving a little slice of every part of it to every human alive would destroy those structures and even if it were done withouth a fight it would leave piles of dead bodies from the lack of production and loss of potential.

I care about seeing as manny people as possible getting a chance of adapting to new circumstances and bettering ther lives wich means doing it togeather with other people. If they dont plan ahead and do constructive stuff including cooperation and dont get their own countries institutions in order they will probably become demand destructed. I cant do much about that and forcing the issue would need military might and that would be a waste of recources that could be used among those who choose productive solutions.

Yes I think it is likey that lots of people will die and I think all of those deaths are due to bad politics including bad religion with a wide definitio of religion. We have as a species not used our most efficient technologies in a wise way and it is unlikely that we ever will be able to save everybody. It does not matter if you or me has the perfect physical solutions since we cant get everybody to do the right things. All these uncertanties and limitations makes global all changing solutions very dangerous since they can wipe out more then they create.

so, cooperate ,educate, communicate.

We don't seem to be very good at any of the above.

One possible result of communication and understanding is conflict.

Advocating remova of all property ownership followed by equal distributin of all stuff while assuming that this would be a good idea is a very effective way of communicating with me.

And I would actually like to live in a society with for instance more socialist communes as long as they respect the rights of other people and constellations of people. My limit for how crazy they can be before I get an itch to intervene in some way is more or less if they start hurting children or when it gets so sect like that relatives start rejecting each other if someone change life style. (The largets spanne in the works of such things is probably the taxation, the government wants its cut of what ever people do to support themselves. )

I have concluded that you are too smart for your own good.

The average human has no idea what you speak of.

I am not present on TOD to discuss with average humans.

But I am fairly sure that average humans can understand these

ideas in a face to face dialogue of sufficient lenght. It could

however take quite a while if you have to start with basic math

and history.

You are certainly arrogant.

Or should I say self-confident.

nuance I guess.

Are you german....swedish....norwegian the way you mash the english laguage is telling.

I am messing with you that is all.

I share that sentiment, however I'm beginning to have serious doubts that the same social structures that have worked for a long time in say Sweden and Scandinavia in general will continue to work into the future, especially in other parts of the world. I'm certainly not suggesting throwing out all infrastructure your culture, or not developing your local economy and becoming as self sufficient as possible.

Trade with ones neighbor is historically the best way forward to prosperity and peace so I'm certainly for that as well. Unfortunately most of the rest of the world wants to live like the Swedish, including myself ;-) however I'm afraid we have passed the time when that is going to be possible. So resource war it will be!

Maybe pestilence and plague coupled with climate change will distract our attention and energy from direct conflict.

The end result is still the same, piles of dead bodies...

Economics of Freedom

Consider this....

Without access to this planet

and its resources you can't eat, breathe,

walk, sleep, work or play.

Land is more than somewhere to live - it is life itself. Without exception, everything around you, EVERY SINGLE THING you use and consume in the process of leading your life are products of the land.

These are the simple facts: If you have no land to live from, you are dependent on money to purchase the products of the land; if you have no money to live from, you depend on employment to gain the money; if you have no employment, then you're dependent on the State; if the State refuses you, you beg for the charity of the rich; no charity, you steal or you die.

Such is the chain which binds us to each other, and to the land.

Whose Planet are we living on?

To live is to use Land - To own Land is to own Life itself.

Every inch of our planet is now owned by some person or organisation.

The majority population (60% to 90%) in EVERY inhabited country are landless - own no part of the planet whatsoever, not even their own homes.

The richest 5% in every nation, rich and poor, North and South, East and West, now own between 70% and 95% of their own countries.

If you do not own enough of this planet to support yourself, and you cannot support yourself without this planet...

Who is it who supports you?

And do they support you...

or through their owning the land that supports you

do they now own you, own your work, own your space,

own your freedom to live as you choose?

If you own no land to support yourself, you must rent, hire or buy it from those that do, so that you may both live and make a living.

If you cannot use the planet to feed, clothe and provide for yourself then to stay alive, you must choose to either work for those who own your planet, to become a thief or a beggar, or to die.

This servitude has taken on many forms throughout history:

slavery, serfdom, day-labour, employment. The only variation being the share of the wealth produced left to the planet borrowers by the planet owners.

This simple reality underlies much of today's poverty, inequality, lack of freedom, unemployment and powerlessness, experienced as the sheer struggle to get by that looms so large in so many peoples' lives.

These latter day pharaohs, the planet owners, the richest 5% - allow the rest of us to pay day after day for the right to live on their planet. And as we make them richer, they buy yet more of the planet for themselves, and use their wealth and power to fight amongst themselves over what each posesses ~ though of course it's actually us who have to fight and die in their wars.

Land is not property ~ land is life.

Land is not created by people ~ it creates people.

We need land ~ but land doesn't need us.

These are the Powers in the Gift of the Land -

the Land Owner owns life: (food, living space, materials ~ for

tools, building homes, cities, technology)

the power to create or destroy people: (famine & war, plenty & opportunity)

and to cut people off when no longer needed: (unemployment, homelessness, poverty, starvation).

The Power in the land is the Power OF the Land

95% of the USA is owned by the richest 3% of Americans

60% of El Salvador is owned by the richest 2% of El Salvadorians

86% of South Africa is owned by the white minority

74% of United Kingdom is owned by the richest 2% of Britons

84% of Scotland is owned by the richest 7% of Scots

Whose Planet are we living on?

The Earth is the mother of our being,

for everything we have and everything we are

is created from her.

Gaia ~ our land, our planet, our only home.

To own land is in essence, to own reality.

http://www.geocities.com/RainForest/3046/index.html

"It depends what you mean by "ownership".

Whatever way we occupy and use space on the planet, there will be those who are responsible custodians and those who plunder. We need to be tough and uncompromising with the plunderers.

Gail, while I agree that what you propose may indeed be what comes to pass, it comes awfully close to that still unpalatable, at least in the US, idea of a Socialist State.

Actually what you describe might even be characterized as outright communism. Note: I am deliberately not capitalizing the word to differentiate it from the meaning it has in political science and all the associated baggage with regards Marxism-Leninism.

I am using this definition:

From Wikipedia, the free encyclopedia

Debt forgiveness should be seen as part of a system of remodeling our basic societal system to something fundamentally sustainable. As I wrote in A Problem of Growth, the fundamental unsustainability of our society is that it's current structure requires perpetual growth--even where (as we are and will see) resource constraints or credit bubbles cause the structure to collapse to a smaller size, it continuously reverts back to searching for ways to grow and expand all over again because its fundamental structure remains the same. I described that structural predicate for growth as hierarchy, but I think debt is the flip side of this coin. Debt--as is made clear by by its alternate name "leverage"--tends to result in hierarchal structures that, because they are in peer-polity competition with other hierarchal structures, must find ways to grow or be consumed by more aggressive competitors. Debt isn't the sine qua non of growth or hierarchy, but we'll find it difficult to address either hierarchy or growth without addressing debt.

That said, while I wholeheartedly support a debt jubilee on all levels (for the reason above), I'm concerned that it is highly unlikely without--or in lieu a threatened--violent revolution. Additionally, it could be devastating in isolation to our current economic model (not that this model needs any help collapsing). Take mortgages: if a widespread jubilee looks possible, then one result may be a dramatic reduction in available credit, which would exacerbate the housing markets' problems even further, requiring the resulting jubilee to be either cancelled or dramatically expanded.

Additionally, because it would take some time to transition our economic model from credit-based to savings-based, there could be significant disruption (economic and political) during this transition period...

Not sure what the impact on energy production would be. My initial thoughts are that 1) oil majors have been more able to continue operations in the midst of credit constraints than other companies because they tended to be in a better cash flow position, and 2) the most detrimental impact would probably be in the alternative-energy startup arena.

In fact the transition will not be from credit-based to savings-based IMHO, but rather will be a re-basing of credit and savings.

I see a transition from "deficit-based" to "asset-based" credit and investment, and the productive assets in question, or maybe "Factors of Production" are:

(a) Location;

(b) Energy (in static material and dynamic immaterial form); and

(c) Knowledge.

I outline my rationale here.

Towards an Economics ofCommon Sense

Sovereign defaults are far more common than one might suppose from the risk premia (

This Time is Different: A Panoramic View of Eight Centuries of Financial Crises; Reinhart, Rogoff, 2008-04-16).

Given the loud noises about the demise of the dollar as world reserve currency, some tectonic shift is clearly countenanced.

I think some complex arrangements are more likely in a bretton-3 than simple dollar default, for example political concessions and agreements over spheres of influence, control of resources, etc.

There is also talk of arrangements with IMF Special Drawing Rights, which could for example be redfined so that the exchange rate to a currency is related to the net credit of a nation plus it's gold reserves in e.g. 1 gram fine = 1 SDR.

SDRs could also be used to 'print' quantities of currency in equal proportion, thus devaluing the money supplies of world currencies in lock-step.

Sovereign default has some subtleties I don't grasp, to do with the relationship between banking grops and nation states - if a nation allows all it's banks to default on non-deposit debt, this isn't quite the same as a sovereign default.

There are reports of international trade shifting towards barter, and I suppose we'll see that in workplaces - public travel passes and lunch vouchers have been commonplace in London for years, and such things may expand.

I overheard yesterday an Irish member of parliament telling his homies that he though rationing (of food and fuel i guess) is possible in future.

So credit and debt may become less meaningful.

The mass media that several generations have grown up with have been enormously effective if pursuading us that we are incomplete without a welter of gadgets and status symbols, and have conditioned us into passive pliant consumers. (watch this stuff (adam curtis)).

As the means to pay the vig on those surround sound systems and 50" plasma tvs subsides, we might find people being more alientated from the mass consumerism, and having the time (being unemployed) to engage in more group activities, politics, social activism, awareness-raising.

I guess whether one's hill of beans is convex or concave will be less important than social skills and charisma.

The mechanisms of production and distribution functions pretty much like a commodity, so this would continue, with fuel and electricity rationing.

It's anyone's guess how the resources will be allocated between countries - perhaps forms of barter will appear here too.

I was talking to a guy who worked in a US bank before the Y2K thing; he said that the bank really couldn't fix their systems, so they actually reverted to a paper based system. I think this kind of return to simpler lower-energy systems [1] could become widespread, so some of the more organisationally-demanding complex solutions mightn't be feasible once the mail is delivered by horse once a week.

Ilrgi is pretty pursuasive that deflation will continue for some time (though I'm hedged 70/30 against deflation/inflation - more because of risk/benefit than probability).

Overall, I think there will be a sort of sobering-up and walking-away-from-the-circus, where the locus of narrative is with the person, rather than the mass society we see ourselves as members of. Community, Food, Water, security - money was only ever a means to these ends, there are many other means.

More than one way to skin a cat (which my german girlfriends' granny knew as "roof-hare").

[1]: sure, paper+ink+horses might end up higher energy overall then netbooks and wifi.

j

I think an important place to start is at the beginning and then walk back from there. It's a structuralist approach, which has its faults (when you take something apart and put it back together, you don't get the original thing: you get the thing that was one thing, then taken apart and put back together) but these are faults I am willing to live with for now.

So, first: What Is Debt?

Debt is a claim on labour. I borrow - I work to acquire funds/resources/whatever to "pay the debt".

That is personal debt - between two sentient beings.

Then there is imaginary debt: the debt between organisations. The national debt does not exist. I don't owe someone in China or the UK a damned nickel. Organisations (governments and corporations) are likewise imaginary. I exist. You exist. Governments and organisations only exist insofar as we "let" them exist.

Viz lyrics by Young Marble Giants from 1980, the song NITA. The emphasis is mine because of relevance:

It's nice to hear you're

having a good time

But it still hurts 'cos you used to be mine

This doesn't mean that I possessed you

You're haunting me because I let you

Shape up your body "Let's be a tree"

Visual dynamics for you to see

Nature intended the abstract

for you and me

(watch it, performed 28 years later by the same group Here)

We let debt haunt us. Example: Today I am in debt. I declare bankruptcy. No more debt. I am still breathing. I still eat. I no longer have to labour to pay off that debt. If I did not labour to pay it off in the first place, causing the bankruptcy, then the debt never existed. If I do not give power to the debt, then the debt has no power. I didn't possess the debt and it only haunts me if 'i let it. This is an abstract point, and only has meaning because "Nature intended the abstract for you and me".

So, we need to unpack this a bit more.

A personal debt (between you and me) is only binding insofar as you and I share a similar notion of property. You're haunting me because I let you: we agreed to this "bond".

An impersonal debt isn't between you and me. It is between classes. Nature intended the abstract...

The ruling class uses debt instruments to get richer. In the end, it is the labour of the working classes that pays it off. A debt jubilee would render signifiers of class distinction meaningless. If I knew that a debt Jubilee would occur on 25 DEC 2009, I could BURY myself in debt and buy a giant mansion and an airplane and a nice car and spend my days snorting coke off some stripper's tits. And afterwards, I'd still have the plane and the house and a burned out septum - just like any other irresponsible jet set jackass.

There will be no credit jubilee. There will be a radical immiseration of the working classes who will be stunned and distracted by their entertainment systems. Killing people "isn't cool" so rather than rise up and actually invent a truly socialist society, they will piddle around with mythologies of wealth, or put their trust in a system that calls itself "socialist", viz Jay Hanson, and do whatever they can to keep their crack/culture/class/whatever habits going.

Again, the Young Marble Giants:

Go for credit in the straight world

Look a dealer in the eye

Go for credit in the real world

Won't you try?

I got some credit in the straight world

I lost a leg, I lost an eye

Go for credit in the real world

You won't die

Instant credit in the straight world

Leaving money when you die

Lots of credit in the real world

Gets you high

Watch them perform it 28 years later Here.

I lost a leg I lost an eye. Go for credit in the real world you won't die.

There is no debt. There is no credit. As far as social object go, only what we say exists.

What you believe is what you see.

If I knew that a debt Jubilee would occur on 25 DEC 2009, I could BURY myself in debt and buy a giant mansion and an airplane and a nice car and spend my days snorting coke off some stripper's tits.

If it was known in advance that a debt jubilee would occur on 25 Dec 2009, no one would lend anyone any money.

I think he meant if he knew it but no one else did.

Actually what he describes is exactly what America is doing. Those among the government class who have brains (not many, I suppose) know this federal debt will never be repaid, and are simply using it to fuel an idiot binge of bailouts, weapons spending, pork, and war.

This is what I argue in favor of running up debt to spend on potentially useful things like stimulus (if it was rationally targeted, a big "if", I grant) and real health care reform. If you knew that shortly all debt would become worthless, the sane thing would be to run up as much debt as possible procuring USEFUL things.

Then when it was all over, you'd still have those things.

But the way things are going, no one's going to be left with anything but a wasteland. Not even any good memories.

Debt is only as valid as it is collectable.

Once this thing blows who is going to come knocking and repossess things that have no "market" to sell them in anyhow?

This entire mess has passed the stage of surreal.

On second thought there is an opportunity here.

A combination repo-man/auctioneer is the future of the US economy.

Once established one can have Goldman underwrite an IPO and sell the overpriced shares to the pension funds for 100s of millions and walk away laughing.

Oh wait, that was the tech bubble.

One man's debt is another man's asset. Hence writing off debt is the same as destroying assets. If all debt is forgiven, then all financial assets are automatically destroyed.

1. No one will lend money and all credit activity ceases

2. Banks will not be able to return money to depositors and all banks will shutdown

3. Corporations and businesses will cease to function when credit is not available to meet payroll and buy raw materials. Also, customers will not be able to buy finished products without credit.

4. There will be a desperate attempt by everyone to convert financial assets into physical currency; this will cause all financial markets to collapse and shutdown.

I just don't see how it is possible to have a debt jubilee. Instead we will have more and more people and corporations go bankrupt which will deflate the value of assets bought with borrowed money (e.g. real estate). Eventually we will reach a new equilibrium when debt reaches a more manageable level.

i think this is what i meant when i said above that debt repudiation is destruction of money:

if i deposit $10 in a bank, they lend out $9. if that debt defaults, $9 of my $10 is destroyed.

Unfortunately, securitization [etc] stuffed all that:

http://gregpytel.blogspot.com/2009/04/largest-heist-in-history.html

But of the .9 of the 9 that gets deposited and lent again and so on.............the fractional multiplier creates roughly 10 times(at a 10% reserve ratio) your deposit in the swindle bankster system and that doesn't blow up into smoke when someone can't pay it back.

It is all notional and that is why everything is crashing..........never existed in the first place.

Thus, as stated above, debt forgiveness equals the destruction of money. Your point four forgets that you have already proved that debt and money are the same and so currency also becomes worthless. Look at a dollar bill. "This note is legal tender for all debts public or private." If all financial assets are destroyed then we would be left with whatever tangible assets that remain in our individual possession. I don't think I'd like that as I am owed a lot more than I owe. But as a proper hedge one ought to secure as many tangible assets as possible come hell or high water.

Great Topic Nate!

Believe it or not, I spend most of my waking hours thinking about - coke and stripper's tits - not that! Debt, currencies, foreign exchange, bond markets ... how to make a living. You know ...

There are many examples of debt forgiveness, one only has to Google 'Bono Debt' and get back over a million hits. I can forgive Ghana's sovereign debt, easily! They don't owe me any money!

The real question is whether the amassed OECD debt is collectible. If it is, than in what form? This is unanswerable right now because there is no consensus about what sorts of income flows will be available in the intermediate future.

If the USA has a $30 trillion GDP then servicing and repaying the current debt load is not too difficult. The issue of whether this $30t is inflation is irrelevant, the debt is also inflation and in an inflationary context all inputs are slso inflated; even rising energy prices and other input costs can be and are inflated; the context allows those closest to the money source to fund the resulting costs and still earn large returns, regardless.

The rest are simply unlucky, too bad for them!

This then is the ideological force behind the Wall Street bailouts and the other strategies of the Federal Reserve, the Treasury and the other Central Banks ... which are all engaged in similar reflationary efforts. Energy costs are real but the most important part of that term is the 'cost' part rather than the 'energy' part.

The short version here then is the current debt burden is manageable provided that a) the structured finance and securitization machine can be restarted and b) energy or social costs don't become too distorting.

Adding to this is the realization that GDP is measured on the curve; growth exists whenever the markets are not actively collapsing says Janet Yellen of the San Fransisco Fed (via Calculated Risk):

The Uncertain Economic Outlook and the Policy Responses.

What this means is the current approach tends to perform an end run around the issue of debt issue since it is simply another cost that can be manipulated. For instance, in China there is growth and this is supporting the US"s funding needs:

With all this maneruvering, is any sort of large scale debt relief possible? What would trigger its application? Will the maneuvers actually work?

First of all, the one realization is the US and other sovereign deadbeats are just that. Can they pay or won't they? This is not easy to answer. Fortunately or otherwise, there is no 'off- planet debtor's prison' where defaulting countries can be sent. While individual can be, the actions of the governments to date have tended to shield individuals; they lose their houses but not their freedom of movement.

Additionally, who would forgive? All countries are running large (temporary) debts in attempts to restart their speculative economies. Debt is being passed back and forth, who are the lenders and are any of them able to make a creditors' claim without that claim being superseded by others? This is a real problem in the mortgage industry where original claims are sold to others, sold again, repackaged and resold, etc. The same actions take place with all kinds of debt and synthetic debt. (Don't ask.)

Additionally, the event or 'Force Majeure' that would be the trigger relief is hard to quantify in advance. It is likely that the establishment would not see a need for relief until circumstances that required it had rendered the issue moot. See Citigruppe ...

If there is a dollar crisis or a default - and a sovereign default under the current commercial/energy constraints would likely be unremedieable - the debt might as well not exist anymore. It would be uncollectible; the US is lucky its neighbors are peaceful Canada and poor Mexico. We are greatfully too far from warlike Vietnam.

As for the rest, it would seem that bankruptcy is the means to do just what is suggested. The knock- on effects are to be felt by the banks and the banks' investors; hedge funds and insurance companies. These in turn will wind up in the hopper, in the end. All roads lead to Washington, DC which has put all of its hopes into the one basket of inflationary speculation.

I doubt the money machine restart efforts will work. The establishment simply has no idea how our current system works. It claims that speculation can improve standards of living and this is demonstrably false. Our Chinese adjunct - and our history - suggests that manufacturing/industrial commercial ventures can propel living standards just as well. This paradigm is grounding itself upon the increasing energy costs and is failing as well.

Any new regime would likely pivot away from debt. A new preferred system would lever toward resources rather than against them; legacy dollar- or money debts would simply not be applicable ... Like debts of the Confederate States of Ameerica.

So yea, we can forgive those.

Jim Willie's latest missive address some of the questions of this Campfire, by the way it is remarkable how Obama's teflon coat prevents even cursory questioning re Goldman's frontrunning of the markets http://www.financialsense.com/fsu/editorials/willie/2009/0716.html

I believe that the debts both on and off the books are so large that they will not-simply cannot- be repaid.

I'm thinking not only in terms of mortgages and credit cards but also pensions and medicare and social security ,etc.

One way of looking at this is that,except for the resulting upheavel,the creditors will have

simply made bad investments,and lost.Just like people why buy the wrong stocks lose.

Younger folks who are paying big bucks into current programs that promise a check or benefits later are going to get a check,probably, but one that represents a negative rate of return.

The folks who enjoyed the easy ride are going to benefit enormously at the expense of the folks who played by Nate's "old school rules".One thing that really frustrates the hell out of me in regard to liberal thinking is that no allowance is made for the people who really have "played by the rules".I personally know many people who have worked two jobs for decadesand gone without many things considerecd necessities by my liberal friends so that they could own a home and hold thier head up and say "I took care of MYSELF and mine and nobody ever give me a thing (-or if not pious,a GODDAMN THING)"

Followed by "And now somebody who pissed away ever nickel he ever made goes to the hospital and walks out an don't pay a dime and but theytook old Joe (or Susie or Garfield) for his last nickel.Had it to do over agin,I'd never even try to get ahead,I'd jis take it easy an enjoym'self"

And the liberals can't get thier heads around this man's value system,and they can't understand why he voted for Reagen.(Or Bush-but he was probably holding his nose as he pulled the lever for Bush.)

(I wonder how many people here on the Oil Drum know how Bush made his personal fortune

at taxpayer expense playing baseball?)

So to get back on track,there are going to be a lot of strange bedfellows against a jubilee,but by some means or another it will come about.

The backbone of the conservative voting coalition may already have been broken by the current economic crash.If not,it may still break as more and more formerly fairly successful voters find themselves on the receiving end of the income transfer schemes,rather than the paying end.

And although I can't prove it,my very strong impression is that people dependent upon government paychecks,military excepted,are about 80 or 90 percent liberal once in the voting booth.And there a lot of them.They can imo be counted on to vote for more government nearly every time.

So we could see a sea change in American politics,and wind up with a lot of nationalized industries,as people come to believe that such is thier best hope of a fair shake.

We might have a revolution similar in many respects to the French Revolution, but hopefully not so bloody, if the people can't get thier way otherwise.And the nature of the game is that a politician COULD rise who is ready to sell of the current ruling class for galley slaves if he thinks doing so will put HIM

in office.

Every system of government and finance/banking/business,so far as I can see,can be gamed.

The winners rig the rules so as to stay on top as long as possible.

But the top,historically speaking,is a very slippery place.

One way or another,peaceably or not,the debts will be ,if not forgiven,forgotten.

I think things may get a little out of hand as the process of debt repudiation unfolds.

If we are really lucky,we might get by with a few million very lenient bankrupticies and a lot of lenders effectively liquidated.

A few of the debtors may feel a little shame in private,but more and more will simply feel like the luck is finally running thier way and celebrate.

Creditors may have to go into hiding.Once the righteous(to them if to no one else) indignation of the working classes is made manifest,nobody who ever accumulated a lot of loot will be safe.

Inflation will play a very large role in the eventual repudiation of current debt,and it might just be the safety valve that keeps the lid on the pressure cooker.

In the end the world will still be here,minus most of the easily exttracted minerals of course,and after things settle down life will again become routine.

And a generation or two or three down the road there will be another crisis as bad or worse.

I wish I had a week to organize and polish this little rant!

ps and to think i used to be a publican!and wrote this!!

if you would indulge a little reductio ad absurdum...

the ultimate "old-school rule" is environmental sustainability, still practiced only by a few tribes in africa, new guinea, and the amazon.

both liberal and conservative thinking makes no allowance for these people, who really have "played by the rules." to the contrary, both studiously exterminated such peoples. when i mention this to a conservative acquaintance, she says "they had low population so they were wasting the environment. it was correct to seize their land."

does this frustrate the hell out of me? it tickles my sense of justice. but if we step back a little, it's obvious that all societies eventually become sustainable. the game, it seems, is to go unsustainable long enough to gain advantage and annihilate sustainable peoples, then collapse, and thus ensure that only your genes stand a chance to live in the sustainable future.

this is amoral, but it's what we do. evolutionarily adaptive traits are amoral, you know. if tapeworms are amoral because they feed on us, are we moral because we feed on plants?

even the most moral liberal is embedded in a society that will follow the arc of unsustainability and collapse, regardless of the liberal's personal moral code.

now here's the interesting bit - those of us who were fiscally sustainable are comparable to the environmentally sustainable peoples we're all guilty of exterminating. do the fiscally sustainable get (fiscally) exterminated this time? are the fiscally unsustainable pulling the same trick on us, that we pulled on environmentally sustainable peoples?

Bmcnet,

You are on the money and we are on the same page mostly.The biggest difference is that I was thinking mainly in terms of American society and the liberal conservative paradigm of current politics,whereas you moved to the broader aspects of world wide society and jumped of from there and expanded my "all....systems can be (and are)gamed."

There is no way Greenish's "capuchin fairness meter" can ever be kept in the green in a world with a lot of people in it,but "It would be Paradise" it that were possible.

The world is and ever was and ever shall be a Darwinian place and the "lower" species will always determine the social rank of individuals by brute strength.

We and the other brachiators will use a combination of brute strength,politics,and deception-the forked tongue,the ethical system that says it is fair to have one employer for every thousand workers,etc,and insists that "it's fair cause you don't have to work for him"

As I remarked in closing,it would have been nice to have a to have week really COMPOSE my comments.

Well, you have your head deep buried in the sand if you really think that any tribe on the Amazon is sustainable. I can't say anything about the others, but I doubt they are all that different.

Besides that, well, great comment.

You may be right - I have never read that Amazonians are sustainable. I may have extrapolated there.

It's worth mentioning that neither the African nor the New Guinean "sustainables" practice agriculture of any form. Amazonians are deeply dependent on manioc (cassava) agriculture, however. This may be the key.

I expect the smart-rich, like Richard Rainwater has already done earlier [google Rainwater Prophesy], to convert their paper assets into real assets. Rich farm land with a good, nearby stream & shallow aquifer/well, then a 10 year-stockpile of seeds and I-NPKS inside the farmgate, plus O-NPKS recycling and much more to stock the bunker.

IMO, Richard will not trade foodstuffs for PMs, big screen TVs, worthless paper currency, or any debt instruments. Now if you have some 'future-oriented' I/O-NPKS plus your volunteered manual labor to trade with him: you might come back home with some bread, bacon, and eggs for your family...

NPKS-->food surpluses-->job specialization-->civilization. How could it be otherwise? We are evolved to do the nightly darkness [no FFs], but not starvation.

Recall my prior postings on this subject: Currency serial # based to exactly correlate with the serial # on a bag of NPKS. No usury allowed, but our future is REAL PHYSICS stockpiled in my speculative 'Federal Reserve Banks of I-NPKS'. Otherwise IMO, we get the dire Ft Knox scenario...

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Turning paper assets into real assets works great for a while. Long term, it may or may not. If land is bought in an area where there is inadequate fresh water, or if a new government nationalizes land owning, if or you have a need to move and cannot sell, the originally great idea may look less great. (Still, I have done some of this myself.)

Printed money is not wealth. Real wealth comes from a productive workforce. Rewarding unproductive behavior (such as extending unemployment benefits, increasing welfare payments, providing free health care, etc.) will cause the collapse of the economy. As Margaret Thatcher once said "The problem with Socialism is that you eventually run out of other peoples money".

Without the free enterprise system, the Republic itself may collapse in favor of the more universal Oligarchy (rule by a small group of elitists). A Bill has in fact been introduced that would eliminate Presidential term limits. Democrats in the House have quashed the ACORN investigation. If the government continues in this direction, the economy and the Republic are doomed.

Since Presidential term limits are in place by Amendment, it would be quite a high bar to pass to repeal them.

Funny thing is, I heard a lot of the same things from Liberals for the past 8 years.

Until more people learn to look past party to what's really going on the game will continue on the same.

Thatcher's Britain had higher unemployment than when 'the other lot' were in charge that the Conservatives replaced.

The answer to unemployment is simple. There is only so much human labour required in the world to live at a certain comfort level. Every labour saving gadget/concept reduces this person hours total.

You add up the amount required, divide by the number of people and make it an enforceable standard 'working day' - or - if that's tricky..

You reduce the statutory working week until employment = 100%

There, that wasn't hard was it?

The truth is that employers and money types don't want 100% employment, otherwise they might have to co-operate with workers - and where would that lead us??

Nations have a different set of morals to individuals.

If I kill it is murder. If my nation kills it is war.

Nations are under no moral obligations to honour their debts.

The nation must only consider the cost versus the benefit of abrogating their debt.

What are the benefits of debt forgiveness? What are the costs?

These are the issues that must be ballanced.

"If not, the discussion is probably still better than watching TV.;-)"